Adopting a new scion cultivar is a crucial decision for tree fruit growers, who must consider both horticultural and market performance. Apple growers have mostly fig ured out how to produce high yields of excellent quality fruit for many standard varieties like Red Delicious, Golden Delicious, and Empire, but market demand for those varieties has steadily deteriorated. On the other hand, many newer cultivars have stellar market potential but bring production and/or handling challenges. For example, consumer demand for Honeycrisp, based on its unique eating quality, has kept returns high, despite the many production and postharvest challenges this breakthrough cultivar brings. The same pattern holds for other fruit crops like cherries and peaches.

ured out how to produce high yields of excellent quality fruit for many standard varieties like Red Delicious, Golden Delicious, and Empire, but market demand for those varieties has steadily deteriorated. On the other hand, many newer cultivars have stellar market potential but bring production and/or handling challenges. For example, consumer demand for Honeycrisp, based on its unique eating quality, has kept returns high, despite the many production and postharvest challenges this breakthrough cultivar brings. The same pattern holds for other fruit crops like cherries and peaches.

Of course, growers want it all: a cultivar with high per-acre tonnage potential, excellent packouts, and huge market demand. Processors and shippers would like a cultivar with outstanding handling characteristics. Retailers would like a cultivar that maximizes the return per square foot of store space.

A recent, nationwide effort by RosBREED socioeconomic researchers is designed to help plant breeders better identify trait priorities and improve their ability to deliver cultivars that consistently provide superior fruit quality to the consumer, and at the same time, value to all members of the supply chain.

The RosBREED socioeconomic team is conducting nationwide surveys of growers, market intermediaries, and consumers about their preferences for new fruit cultivars. A survey of shippers, packers, brokers, processors, and other marketing intermediaries was conducted in April 2011. A written nationwide survey of fruit growers was conducted in January 2012, and a nationwide online survey of consumers along with an economic experiment (on apples only) will conclude in November 2012.

In this article, we report the results from 12 interactive audience surveys using clickers at major industry meetings held nationwide between December 2011 and August 2012. Respondents, who were mostly growers and orchard managers, provided their opinions on the fruit quality and plant attributes they believed were most important for fresh apple, fresh and processing peach, sweet cherry, tart cherry, and fresh strawberry varieties.

Apple

The audience surveys of apple growers targeted orchard owners or managers with the authority to make the decision to adopt a new cultivar. There were 98 participants in New York, 92 in North Carolina, 90 in Washington, 78 in Michigan, and 72 in Minnesota. Regional variation was apparent for size of operation, as 62 percent of Washington growers had more than 100 acres, compared with 49 percent in New York, 32 percent in Michigan, 22 percent in North Carolina, and 15 percent in Minnesota.

Return on investment, potential market performance, and fruit quality were the three most important factors impacting the decision to adopt a new apple cultivar across all five states surveyed (Figure 1). Few respondents considered orchard issues, such as horticultural performance, reduced spray needs, or labor availability, as the most important factors in adopting a new cultivar.

In all five states, respondents agreed that the most important attribute was fruit flavor, followed by fruit crispness (Figure 2). Overall, less than 10 percent of respondents considered fruit firmness, sugar/acid balance, disease resistance, or shelf life at retail as the most important factor.

Processing peach

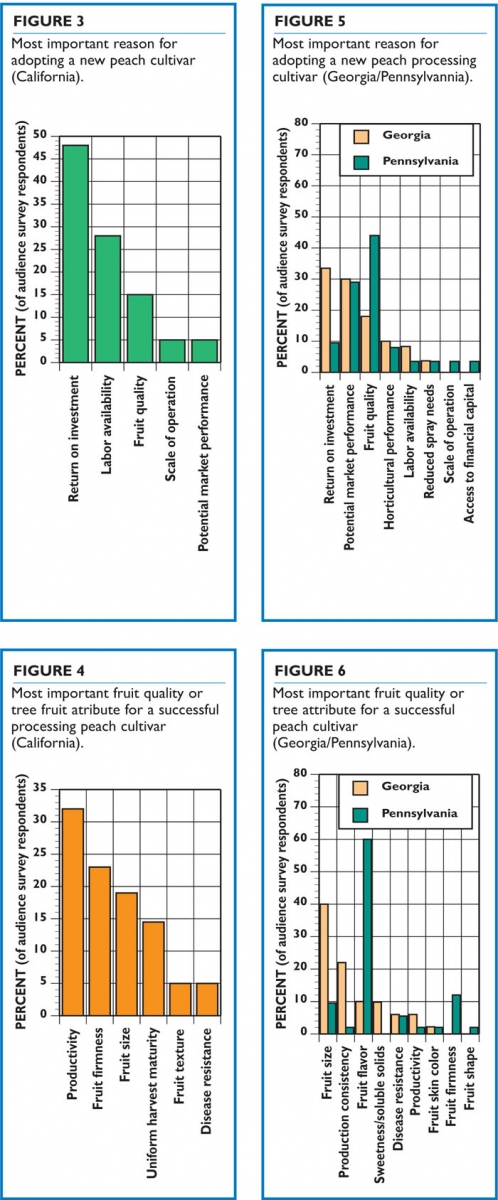

Twenty-six California processing peach growers signaled return on investment as the most important reason for adopting a new cultivar, followed by labor availability, and fruit quality (Figure 3). Productivity was rated as the most important attribute for a successful cultivar by a third of the respondents, followed by fruit firmness, fruit size, and uniform harvest maturity (Figure 4).

Fresh market peach

The Pennsylvania (mostly producers from the Mid-Atlantic states) and Georgia (from southeastern states, mostly South Carolina) meetings had 33 and 30 participants respectively.

Some striking differences between the regions were evident. Southeastern respondents tended to be involved in larger operations than those from the Mid-Atlantic. Thirty-three percent of Southeast respondents indicated that return on investment was the most important factor impacting the decision to adopt a new cultivar, compared to only 9 percent in the Mid-Atlantic (Figure 5). In contrast, 44 percent of respondents from the Mid-Atlantic considered fruit quality the most important versus 16 percent of south-eastern respondents (Figure 6).

A number of differences were also evident in importance of fruit or tree attributes. Mid-Atlantic respondents placed higher importance on fruit flavor and less on fruit size than respondents from the Southeast. Respondents from the Southeast considered production consistency and soluble solids to be more important than those from the Mid-Atlantic, while the latter considered fruit firmness and shape more important.

Sweet cherry

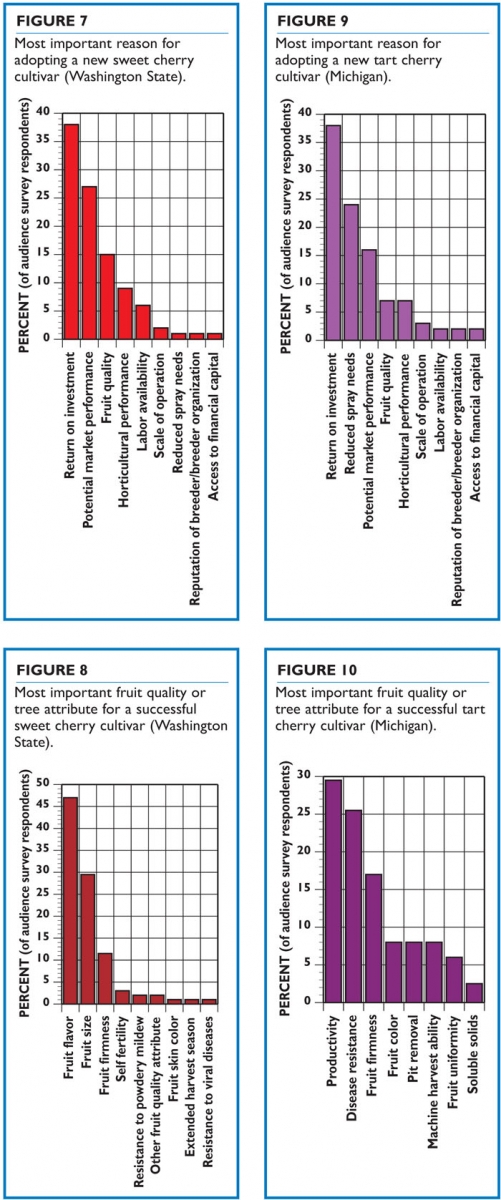

A survey of 101 sweet cherry growers in Washington indicated that the two most important factors impacting the decision to adopt a new cultivar were return on investment and potential market performance, followed by fruit quality, horticultural performance and labor availability (Figure 7). Fruit flavor was the most important fruit quality attribute, followed by fruit size and fruit firmness (Figure 8).

Tart cherry

Tart cherry

In a survey of 59 growers in Michigan, return on investment, reduced spray needs, and potential market performance were signaled as the top three factors impacting a decision to adopt a new cultivar (Figure 9), whereas productivity, disease resistance, and fruit firmness were the most important fruit quality or tree attributes (Figure 10).

What next?

These surveys provide a systematic snapshot of the attitudes of a range of producers. While these results are based on a sample, the overall results are quite consistent and will be complemented by the results of our other socioeconomic studies.

The RosBREED socioeconomic team is now compiling and analyzing the data from the surveys of marketing intermediaries and growers, and reports will be publicly available soon. This fall, the team will conduct a consumer economic experiment focusing on fresh-market apples to assess consumer preferences and willingness to pay. Finally, the team will complete a nationwide online survey for consumers.

Our socioeconomic studies of fruit supply chain members (growers, packers, shippers, marketers, and consumers) are both comprehensive and unprecedented. Results will provide broadly useful information as well as helping scientists use marker-assisted breeding to target traits more efficiently and effectively.

For more information, visit the project Web site at www.rosbreed.org.

Leave A Comment