When the U.S. Apple Association convenes in Chicago later this month for the Apple Crop Outlook and Marketing Conference, three things will be on the minds of the more than 300 growers, packers, and shippers who come from all over the world to meet there every year.

1) What is the size of the apple crop?

2) How will growers in the eastern United States get back into the market after producing at best half a crop last year and now coming in with a bigger-than-usual crop?

3) Where will the apples go that usually go to Europe (a small percentage, admittedly) but now will be limited by the European Union’s decision to dramatically lower permitted residues of the storage scald inhibitor diphenylamine?

For the first time, this year’s outlook conference will be a critical source of information about this fall’s crop size, quality, and variety. The conference will be held August 22-23 in the Ritz-Carlton Hotel in downtown Chicago.

In past years, USApple members have had the U.S. Department of Agriculture’s August estimate of the crop size to provide some guidance. This year, no new-crop estimate will available; the USDA suspended it because of reduced funding.

In fact, for budget reasons USDA halted its entire noncitrus fruit, nut, and vegetable program analysis and reports—including the 2013 apple new-crop estimate in August and the July final 2012 apple crop production report. (The USDA did manage to come up with an estimate of the 2012 crop size.)

Mark Seetin, USApple’s director of regulatory and industry affairs, said it requires some scrambling to adjust to the loss of the reports, but he believes the industry has a good alternative.

USApple conducts detailed storage reports every month starting in December. “We were able to establish a correlation between the USDA estimate and our storage reports,” Seetin said. “We know that, very consistently, 42 percent of the U.S. apple crop goes to market by December 1.” So the storage reports will give a close estimate of the total apple crop size without the USDA estimate.

This is important to USApple. The USDA estimate had been used to determine how much dues money member states pay to USApple to support its grower and consumer information programs.

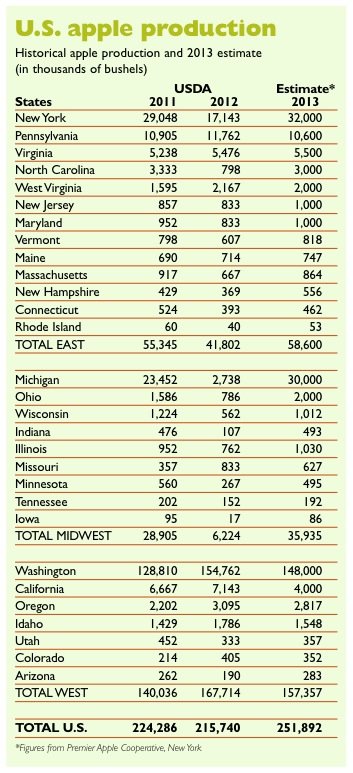

Already this year, two estimates of the U.S. apple crop size have been made (see chart). One came out of the 58th annual Fruit Crop Guesstimate on June 19 in Grand Rapids, Michigan. The Michigan Frozen Food Packers Association (MFFPA) and its 14 members sponsor the annual event, which draws processors and packers from across the country.

The Michigan group estimated the U.S. apple crop at 251.8 million bushels. A second reporting group, members of Premier Apple Cooperative met in New York in late June and came up with an estimate of 251.9 million.

While the totals were very close, there were some big differences in individual states. The Premier estimate of production in New York State was 32 million bushels, 2 million less than the Guesstimate. And the Premier estimate for Michigan production, at 30 million bushels, was nearly 4 million bushels more than the Guesstimate of 26.3 million.

The Michigan Guesstimate also saw 8 million bushels in California, twice the Premier estimate of 4 million.

So, the USApple estimate that comes out of the Chicago conference will have some numbers to reconcile.

Both estimates pegged the size of the Washington crop at 148 million bushels.

“If the crop comes in at 250 million bushels, that is very manageable and not a record by any means,” Seetin said. It would in fact be ninth largest, with the largest being 277 million bushels in 1998.

Exports

Apple growers are increasingly concerned about the growing size of the U.S. fresh apple crop. In a meeting in April with the new Washington State agriculture department director, Stemilt Growers’ president West Mathison underlined the importance of access to overseas markets.

The apple industry had had a very good run the last five to seven years, he said, and while the nursery industry is enjoying great sales of apple trees, all those new trees pose serious supply issues. “I am very concerned about the industry over the next five years,” Mathison said. “There will be tremendous pressure on our industry to adapt to that volume. We’re not going to push 20 million (more) boxes through Safeway, Kroger, or Costco. It’s going to have to go to Indonesia and China,” he said.

Seetin of USApple said the decision by the European Union to greatly reduce the residue tolerance of diphenylamine (DPA) would likely lead U.S. shippers to abandon the market. But while that will have an effect on some shippers in New York State that sold Empire apples to the United Kingdom, overall the European market for U.S. apples was small.

“Exports are growing at a record pace again this year,” Seetin said. “With two months remaining in the marketing year, exports had already matched last year’s record, so this will be a new record.” Exports last year were 44 million bushels.

“We already do pretty well in export markets,” said Diane Smith, executive director of the Michigan Apple Committee. “But the potential for expansion is there.” Michigan’s exported apples go south, not east to Europe. Central America is a key market, although not many apples go to Mexico. Some go to the Caribbean countries and to Colombia.

A couple of big events in Brazil—the World Cup in 2014 and the Summer Olympics in 2016—provide great potential for building apple sales, she said. The Central American markets take smaller apples and Michigan packers are trying to capitalize on that.

Leave A Comment