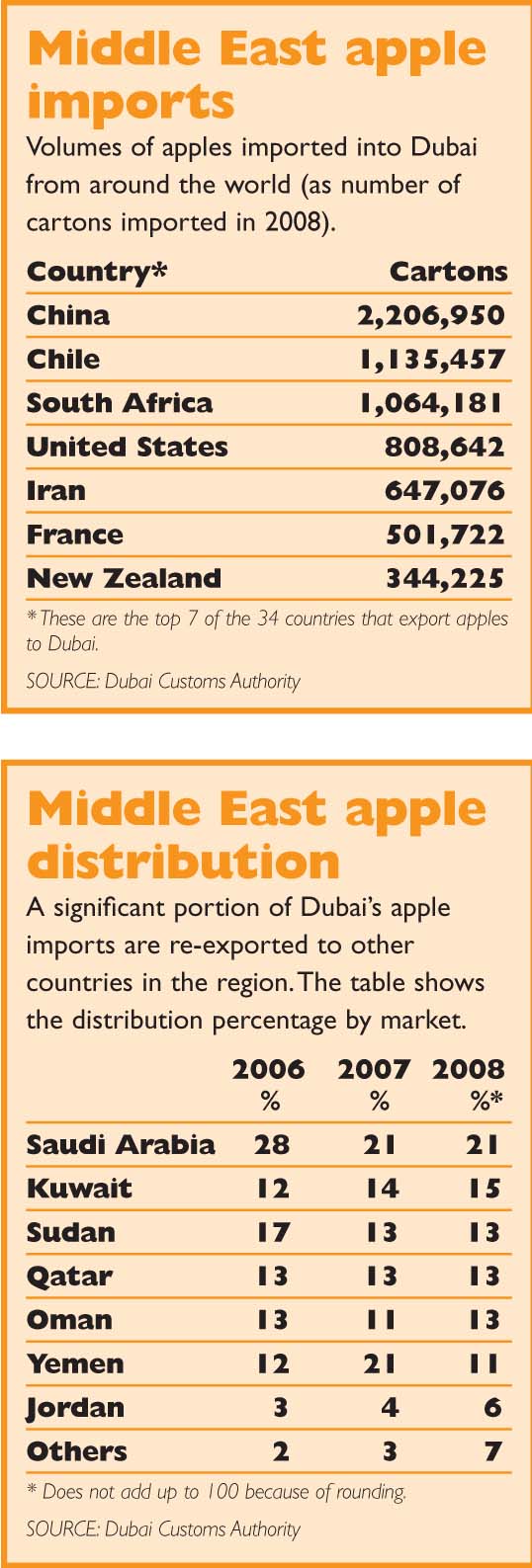

Dubai, one of the United Arab Emirates, is the major fruit import port in the Persian Gulf with its trade tentacles reaching to Yemen in the south, Iraq in the north, and Sudan in the west. It’s difficult to separate out specific countries as independent and uninfluenced by the Dubai traders.

With the recent exodus of a major importer in Saudi Arabia, Dubai importers are scrambling to fill the void and get a share of the vast Saudi Arabia market. Price is king in this ultracompetitive market as most apple-producing regions of the world supply Dubai.

Re-export of Washington apples from Dubai varies by importer, ranging from 30 percent to 80 percent based on each importer’s specific business model. Some aggressively execute on every opportunity outside Dubai, while others focus on the hotel, restaurant, and institution market and value-added products (fresh cut) within Dubai proper. It’s clear Dubai is the engine fueling increased imports into the region, and re-export is obligatory due to the limited size of the market.

The Middle East region is quite small. Egypt (population 77,898,000), Iran (74,196,000), Sudan (39,747,000), Iraq (30,747,000), Saudi Arabia (25,721,000), and Yemen (23,580,000) make up the major markets. Dubai is 1.37 million with all United Arab Emirates accounting for only 4.6 million people. Dubai is a re-export port out of necessity, and the Washington Apple Commission’s focus will be to these peripheral markets.

The region is a secular society divided into those that “have” and those that “serve.” Although the region has a large expatriate (serve) population, their average wage is only U.S.$600 per month, and they don’t have the purchasing power to buy Washington apples. In some cases, the expatriate population equals the nationals. Kuwait’s population is 2.5 million, of which 50 percent are expatriates. And, as you look around, it’s clear the haves are dependent on this relationship. As the nationals grow in girth and diabetes runs unchecked, health and nutrition will become a major promotional campaign today and in the future.

Iraq is on everyone’s minds and has huge potential, providing the bullets stop flying. Our Middle East representation is providing a market research project identifying the current players so we can watch the evolution of the marketplace. Now is not the time, but a day soon will come that a visit is warranted. The Sudan market will require watching as well, but this will be a market heavily dependent on those that have the resources to buy apples. I anticipate Egypt being the primary supplier due to proximity, but further research and evaluation is warranted. Iran is the jewel in the region, minus the politics of course.

Gaining access for apples into Iran needs to be a priority of Washington State. A large population base, youthful society, and money are all very positive attributes to the success of Washington apples. However, the current political climate doesn’t provide opportunity, and, in fact, it eliminates it. We’re doing preliminary research on who the players are in the market. Access for the Washington apple industry isn’t practical today, but I guarantee the expertise of the Dubai traders will find a way if demand exists.

The future market potential lies in markets with difficult access issues, such as Iraq and Iran. If access were permitted, we could see a dramatic increase in Washington apple shipments into the region. I foresee a stable Middle East market, providing everybody plays nice, but price is the key component to increasing volumes. In-depth research of importers in subsidiary markets is a must with the recent changes in Saudi Arabia. Be cautious.

Leave A Comment