America’s juice grape industry is slowly crawling out of its period of low prices and oversupply, and likely will continue to rebound.

Cash prices to Washington growers have risen $60 per ton since prices crashed due to oversupply in 2014, and the market looks more stable now that growers have pulled out some acreage in recent years, said market analyst Trent Ball.

“Looking forward, I would expect that the cash price should continue to increase slightly, as it has,” said Ball, chair of the Yakima Valley College agriculture department.

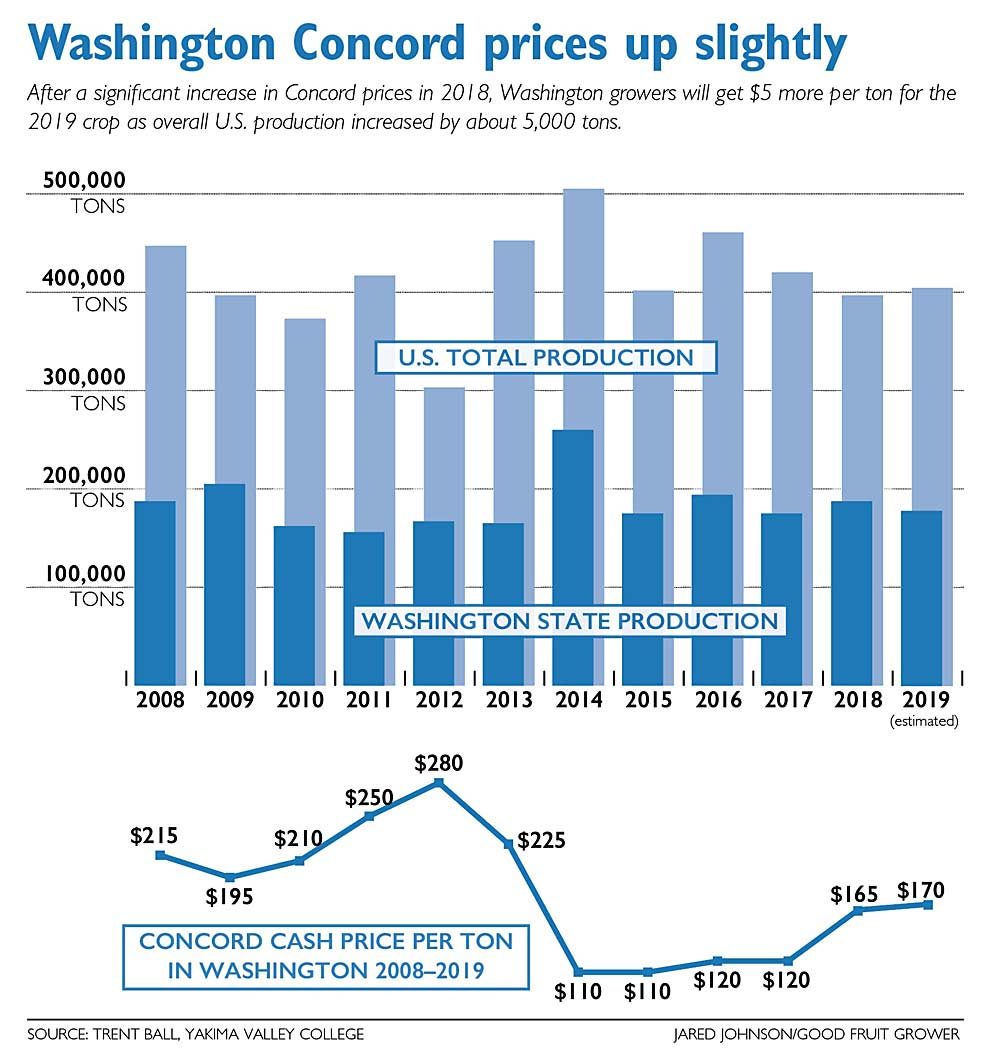

In 2019, cash prices in Washington were $170 per ton and were $230 per ton on the East Coast, Ball said. Overall, the nation produced 404,000 tons of Concords. Washington, the nation’s leading producer, accounted for 176,000 tons. New York contributed about 120,000 tons, while Michigan, Pennsylvania and Ohio chipped in the rest.

In the East, the Concord wine market is growing and winemakers are paying $250 per ton, a separate price from the $230 paid for juice.

Ball delivers his “State of the Grapes” presentation at the Washington State Grape Society’s annual meeting each November, giving growers a snapshot of the industry’s balance of supply, demand and prices. For several years, that balance was a little out of whack.

In 2014, the nation produced more than 500,000 tons of Concord grapes, and Washington cash prices plummeted to $110 per ton. Production dropped and prices have been inching up since. The same pattern happened in 2005 to 2007.

In fact, Ball uses a chart tracking the production and price points of juice grapes in his economics classes to illustrate the classic example of supply and demand cycles.

Acreage removal in recent years has helped stabilize prices and volumes, Ball said. Acreage will continue to drop, though probably at a slower pace, in the near future, he said.

Washington growers have been dropping acreage gradually, taking out 400 acres in 2019 for a total of about 17,100 in production. In Michigan, growers removed about 1,500 acres as part of an incentive program. New York and Pennsylvania growers also have been taking out vines.

Unusual fall weather — a freeze put an early end to harvest — definitely affected Washington’s production this year, but Ball said he did not know the extent of the impact.

“Our growing degrees were good but really the season is going to be defined by what we saw in September and October most likely,” he said. “Very unusual weather conditions for our region.”

He suspects the fall 2019 weather may affect the vines enough to reduce the 2020 crop.

Washington Niagara grape production dropped in 2019 to about 14,000 tons. Figures for Eastern Niagara production were not available, Ball said.

Juice grape imports, mostly from Argentina, are lower than in 2014, but they continue to affect the market and were on pace to come in at higher volumes in 2019 than the previous year. •

—by Ross Courtney

Related:

—Phylloxera, economics highlight the 2019 Washington State Grape Society annual meeting

—Higher prices for juice grape growers in 2018

Leave A Comment