Think of it as online dating for agricultural investments.

Growers seek cash. Capitalists seek farms. They both have the internet. Thus, web portals that aim to pair the two are popping up and gaining some traction in the tree fruit industry.

“Internet syndicators” is the term used by Jake Cutler, a California consultant for an agricultural investment company that recently purchased a Tulare County almond orchard property through AcreTrader, a farmland investment platform headquartered in Arkansas.

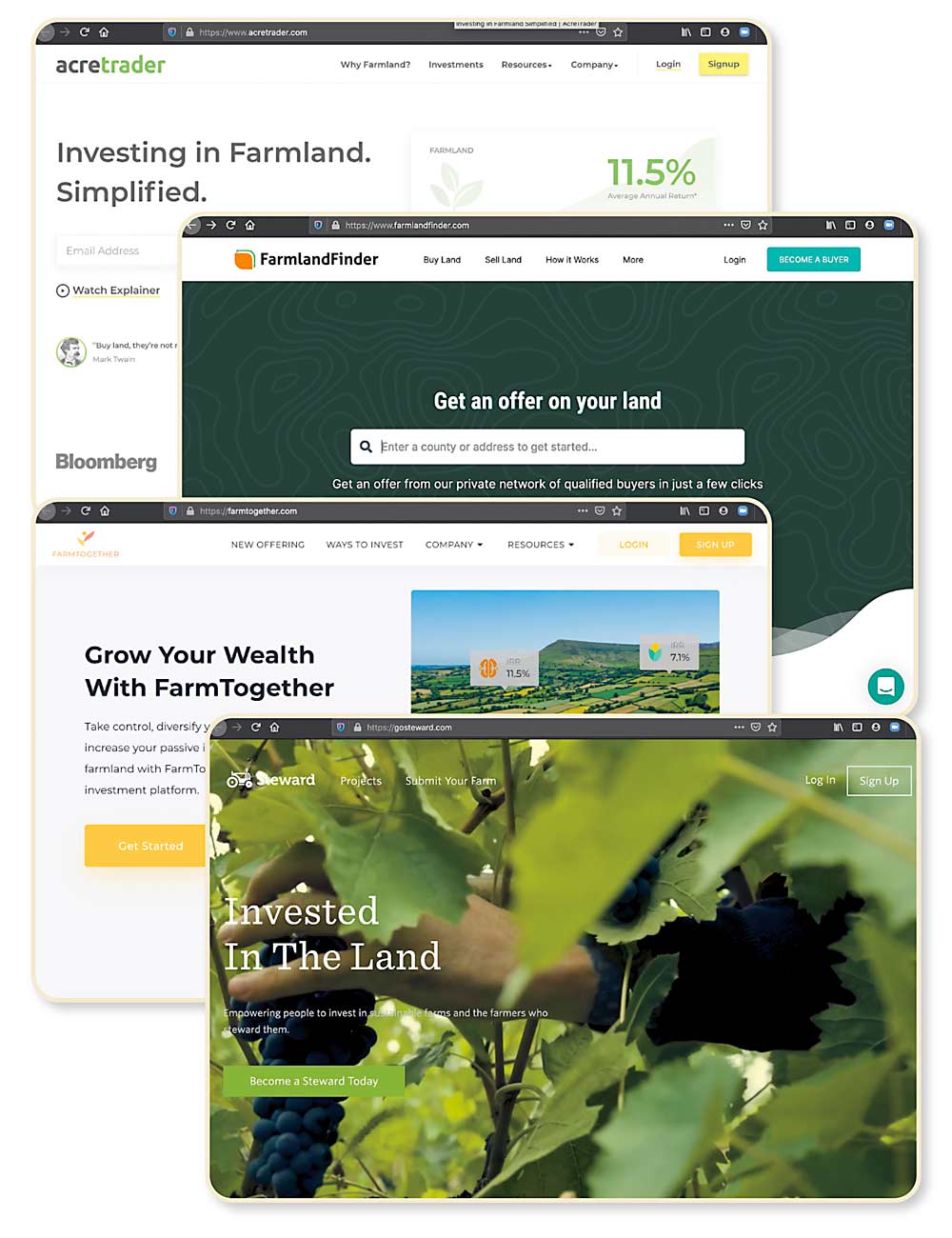

Off-farm money is not new to the tree fruit industry, but websites such as acretrader.com, farmlandfinder.com and farmtogether.com broaden the access beyond typical venture capitalists and institutions to others, such as mutual funds or pension funds.

“It’s accessible to an individual investor,” said Cutler, also a third-generation almond and citrus grower.

In fact, agricultural investment is hot right now, as investors look to diversify their portfolios and see farmland as a safe bet.

“Food is a big topic right now,” said Garrott McClintock, chief operating officer of AcreTrader, who grew up in a farming family. “People are interested in investing in the future of food production.”

Most of the properties on the websites are row crops or nut orchards in California, but a few tree fruit farms have popped up.

Through AcreTrader, Jim Jackson of the New Royal Bluff Orchards near Royal City, Washington, raised about 10 percent of the capital needed to plant 130 new acres of apples and cherries this spring. The rest came from other sources — family, friends and other people he knows — over the past seven years. The internet was faster. His first round — or tranche — of crowd-sourced fundraising reached its goal in 36 hours. The second sold out in just three hours.

“It was very successful, very successful,” he said.

The property, still listed on AcreTrader’s website as “closed,” advertised to potential investors 7.7 percent average net cash yield (cash payments to investors) and between 7.7 percent and 12.1 percent net annual returns, which includes expected appreciation of the property.

Another Columbia Basin property, called Galaxy Organic Apple Orchard, is listed on FarmTogether. In that case,FarmTogether’s investors will straight-up buy the property and contract Stemilt Growers of Wenatchee, Washington, to operate the farm, according to the property listing on the website. In November, the company began seeking $13.7 million for the 201-acre orchard that will be redeveloped from Red Delicious and Granny Smith to SweeTango and Cosmic Crisp apples. FarmTogether estimates an expected 15 percent internal rate of return and a 19.6 percent net cash yield with a target hold of 10 years.

Stemilt liked that the FarmTogether staff has agriculture experience, shared philosophies with the fruit producer and established terms and expectations in advance, said Stemilt CEO West Mathison.

“Our current deal was a good fit for everyone,” he said.

Selling outright is not the only way, said Josiah Terrell-Perica, director of farmland investing and a co-founder of FarmTogether. The companies that run the platforms also arrange sell-and-lease-back or profit-share arrangements in which farmers keep working and maintain their emotional attachment to property that has been in their family for generations.

“Farmland transactions are more than exchanging dollars for ownership, but rather problem-solving in a mutually beneficial way,” Terrell-Perica said.

Small growers should include such internet-based brokers when they seek capital, said Michael Butler, chairman and CEO of Cascadia Capital, a Seattle, Washington, investment firm that works in the tree fruit industry.

“(Banks) have clearly tightened up and it’s putting pressure on small growers to find alternative sources of capital,” Butler said.

Desmond O’Rourke, an apple industry economist in Pullman, Washington, advised caution and carefully weighing the sacrifices in autonomy required for the outside funding. Also, make sure the expected returns are reasonable, based on the characteristics of the farm; a 7.7 percent return would probably require organic fruit or proprietary varieties, not Galas, he said.

And make sure you have a relationship with a successful marketer and “reasonable chance of making money,” he said. If you don’t, “then you shouldn’t be out there looking for outside investments.”

McClintock of AcreTrader suggests the usual: Make sure you have accurate and detailed budgets and ledgers to market your farm, but also prepare to “market yourself, as well,” he said. Some investors want to choose farmers with values they share, such as local, organic and sustainable. (Another popular farm investing site, gosteward.com, specializes in sustainable farming.)

Produce videos and use social media to share your story, for example. Many investors like that.

“They feel like they get to know this person as well as we get to know them,” McClintock said.

—by Ross Courtney

Leave A Comment