Growing organic apples is hard, but reading their market can be just as hard.

Overlapping, though not conflicting, messages characterized the first organics session in several years at the Washington State Tree Fruit Association Annual Meeting in December in Kennewick.

Despite growing demand for organic food overall, the apple segment has become relatively flat in recent years. Today, organic apple production may or may not pay off, depending on variety and a grower’s philosophical view of production costs.

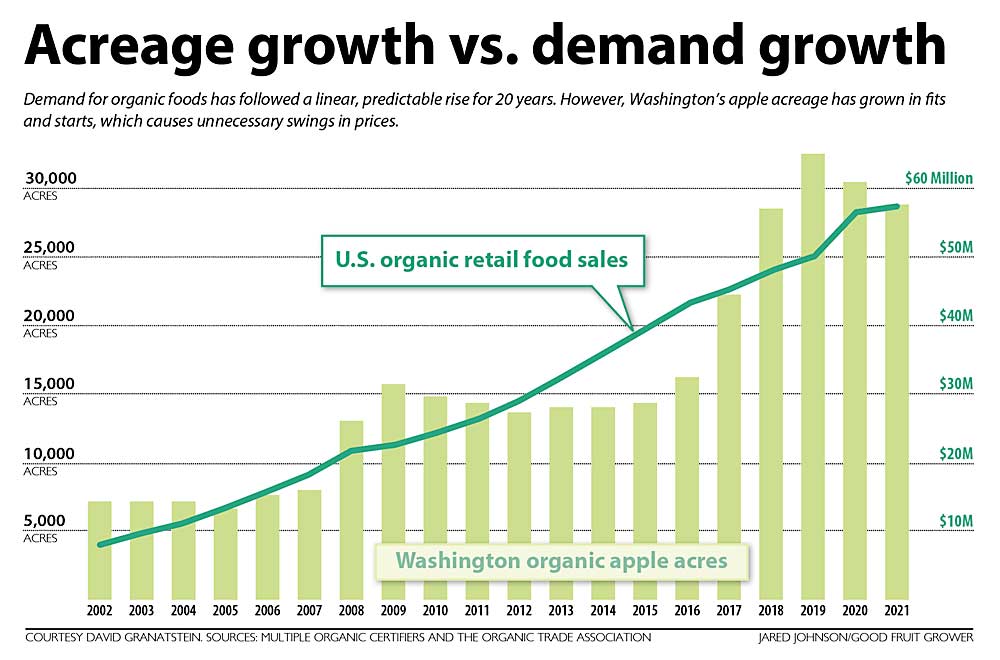

Organic food sales have followed a steady upward curve over the course of 20-some years, said David Granatstein, a Washington State University professor emeritus of sustainable farming, at the annual meeting. With that clear demand trend, the industry has few excuses for overproduction.

“It’s entirely in your control,” he said in a follow-up conversation with Good Fruit Grower, repeating a message he has delivered for many years.

Using data from several organic associations, he compared the rise of U.S. retail sales of organic food and the rise of organic apple acreage in Washington. The sales climbed at a steady pace year to year since 2002, but acreage has grown in stairsteps, sometimes lagging demand, sometimes overshooting it.

“We should start trying to avoid these periods of overproduction,” he said.

Digging deeper, he also noticed increases in volume typically trend with decreases in prices, and vice versa. He suspects the market is reacting to crop sizes, which fluctuate year to year with weather, instead of anticipating them.

However, the good news is that inflation-adjusted organic apple prices have held steady, or even risen a bit, despite the huge increase in volume over 20 years, he said. Normally, after the novelty of something new wears off, prices start to come down.

Steady shares

Three marketing panelists at the annual meeting saw things differently.

Though optimistic about organic potential, they pointed out that the share of organic sales in stores has been flat recently, not counting a pandemic spike in 2020.

“I just think we’re holding steady,” said Catherine Gipe-Stewart, director of marketing for Domex Superfresh Growers. She joined Tate Mathison, Stemilt Growers vice president of sales and marketing, and Garrett Joeckel, vice president of operations at CMI Orchards, on the panel.

Gipe-Stewart and Mathison spoke to Good Fruit Grower after the conference.

The share of organic apples sold in U.S. stores spent three years at roughly 8 percent before spiking to 12 percent in 2020, the start of the COVID pandemic, and has held steady since then. Pears followed a similar trend, going from 5 percent to 10 percent.

The panelists suspect the psychology of organic shoppers contributes. They expect organic apples to be more expensive for their perceived quality, safety and environmental attributes, Gipe-Stewart said. According to surveys by retail insight firm Category Partners, two-thirds are willing to pay between 10 and 50 cents more for the organic label, while 23 percent will tolerate a markup between 80 cents and $1. Only 6 percent are willing to pay any price.

Mathison thinks packaging could tip the scales. Hard-core organic shoppers buy in bulk, but packing organic apples in bags or boxes and displaying them anywhere in the store would convince more price-sensitive shoppers, who have already demonstrated they want more packaged fruit.

“(With) an organic bag, you can target more than just the pure, organic person,” Mathison said.

Sacrificing some price-per-pound premium might even be worth it, he said.

Packaged organic and conventional apples ring up at roughly the same share of dollar sales for each category — 58 percent and 57 percent, respectively, according to Nielsen data. When it comes to volume, however, 61 percent of organic apples move in bags or boxes, and the overall organic packaged volume grew between 2022 and 2023 by 10.8 percent, compared to 7.5 percent for conventional apples.

Packages labeled as organic just move apples faster than bulk displays. “Customers understand it better,” Mathison said.

Organic budgets

Going organic still seems to pay off, especially for Honeycrisp, said Karina Gallardo, a WSU agricultural economist.

Her 2022 enterprise budgets for organic Gala and Honeycrisp apples yielded break-even box prices of $37.33 per box f.o.b. for Gala and $60.14 for Honeycrisp.

For Honeycrisp, that’s lower than the $72 per box they fetched in the marketplace in 2022, according to several price sources Gallardo used for her presentation. Gala earned $36 per box.

However, Gallardo’s number-crunching relies on certain assumptions that not all growers make. For one, she includes opportunity costs, an economic term for the money you would have made had you taken an alternative investment path other than organic farming.

Growers relate better to accounting costs, such as how much they pay employees, spend on chemicals and lose each year in equipment depreciation, she said. The sum of accounting costs and opportunity costs she calls “economic” costs.

“We are covering all accounting costs, but we are not covering the economic costs,” she said in the meeting. “That is the story for the organic Gala.”

Excluding those opportunity costs, the break-even prices drop to $31.06 and $60.14, respectively, meaning both organic apples showed profits.

However, a big question mark looms this year, as the Washington industry wrestles with a 140-million-box crop from 2023. Through the end of December, average f.o.b. prices for organic Gala and Honeycrisp were $32.66 and $58.85, respectively, according to the Washington State Tree Fruit Association. At those prices, and using Gallardo’s 2022 assumptions, neither variety would make a profit over economic costs, while Galas would just barely clear accounting costs.

—by Ross Courtney

Leave A Comment