After a challenging 2023 season, the team here at Northwest Cherry Growers is focusing on what we need to do to increase consumer demand and retail purchasing activity.

In recent years, we focused a large portion of our consumer outreach efforts on extolling the health benefits of our fruit. We have seen this move the market forward in a positive way over the past several years, as both retailers and consumers respond positively to health messaging. Now, we see several of our shippers jumping on board by adding health statements such as “Northwest Cherries are a natural anti-inflammatory” to their packaging!

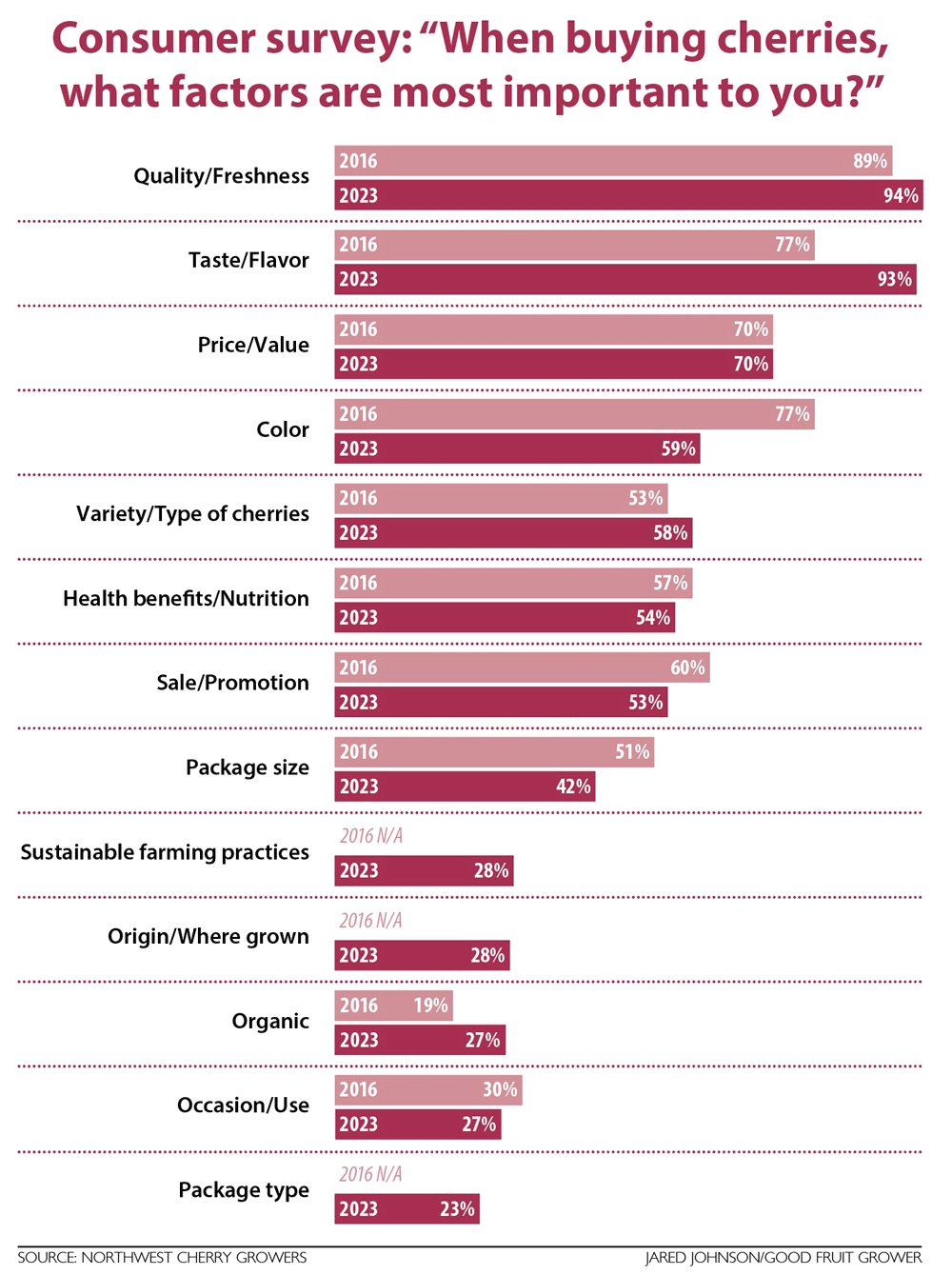

We are also very interested in other factors that come into play when a consumer decides to purchase cherries over items like grapes, strawberries or blueberries. A 2023 consumer attitude and usage study that interviewed over 2,000 cherry-purchasing consumers found the key drivers on purchasing decisions continue to be quality and flavor. These attributes are critical to both repeat and impulse purchases, which are both needed to successfully sell the crop.

However, the next most important factor is price.

Last year, we did a study on consumer purchase decisions as they relate to retail pricing. This topic is critical to our success, and we only have to look at June 2023 to get an idea of how important pricing is in moving each year’s crop.

The average promoted retail price in June 2023 was $4.69 per pound. We learned that an average ad price of $4.69 per pound did not help move the volume of fruit that was available in that timing window. It is also important to remember that for every retailer who had cherries on ad at $4.69 per pound, there was another retailer that didn’t have cherries on ad, and the “everyday” price was closer to $7.99 per pound. At the end of the day, that pricing was not attractive enough to move cherries through the system at the velocity that the West Coast crop needed. This was largely an issue that was driven by the California industry — by the time Northwest growers picked their first cherry, the world cherry market was for the most part saturated with excess availability of fruit.

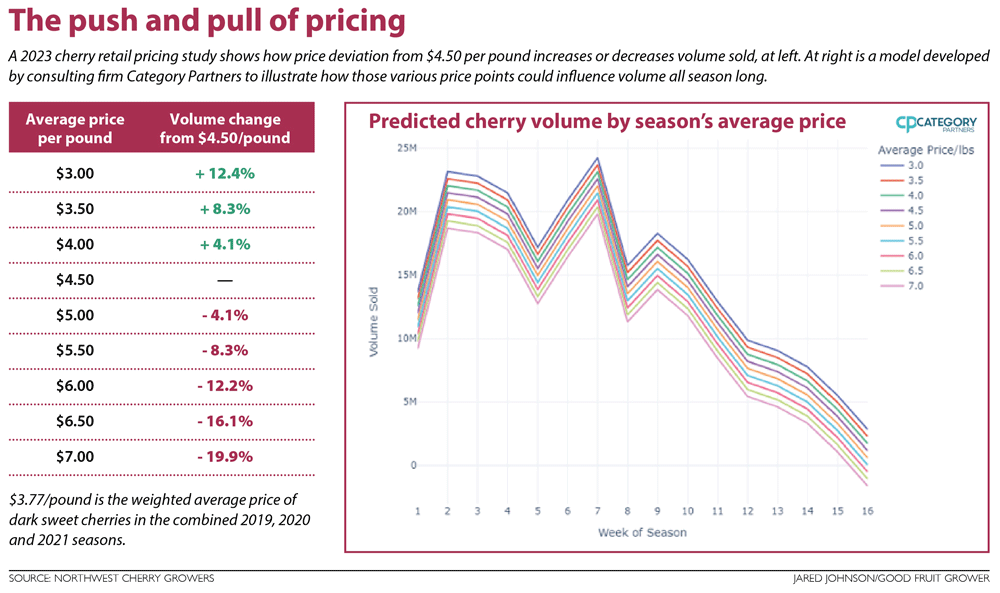

As a result, the Northwest Cherry Growers conducted a separate consumer retail pricing study that provided some interesting insight into what our domestic cherry consumers are willing to pay for our fruit. What we learned was that once the retail price hits $4.50 per pound, or higher, the sales begin to drop off quickly.

Observations from this study:

—Over the past three seasons, the weighted average promoted price for dark sweet cherries is $3.77 per pound.

—Using a prediction model based on the past three years’ volume data, dark sweet volume will begin to decline as price increases beyond the $3.77 average price point. However, retail revenue does not begin to level out until dark sweet average price per pound reaches the $4.50–$4.60 range.

—In dark sweet cherries, consumer volume in the East Coast and West Coast regions is more responsive to changes in conventional price — meaning ad activity drives consumers in these regions to make purchases.

—In Rainier cherries, consumers in the Northern and Eastern U.S. states are generally more responsive to changes in price.

—The average price-per-pound differential between conventional dark sweet and Rainier cherries was $2.58.

—Organic cherries have a more widespread price range than conventional, often with several scattered, leading price points.

For larger crops, it is clear that ad pricing in the $2.99 to $3.99 range would provide an attractive retail price for consumers — as well as help move the volume of fruit we see on larger crop years. This also leaves enough room for growers to receive a return to the land, which, from our industry’s standpoint, is the most important issue.

In recent months, there has been a great deal of national media coverage around retailers using inflation as an excuse to increase retail prices across the grocery store. While we do not get a say on how a retailer develops its annual profit strategies, the key for us as suppliers is to make sure we receive a return that allows us to continue to produce the food required to feed our nation. Certainly, an advertised price point of $3.99 per pound on cherries leaves enough “meat on the bone” for our growers to share in the profits being realized by the retail side of our business.

In 2024, we will run promotion programs across the United States and in 16 export markets.

2024 crop outlook

As of writing this column in mid-April, the 2024 Northwest crop looked to be running about normal, and we expect a June 1 start date in our earliest orchards. Over the winter, our late growers (mostly above 2,000 feet) saw several cold nights (minus 18 degrees Fahrenheit in several locations) that have resulted in a drastically reduced late crop. We are hearing that our friends to the north, in both Montana and Canada, were also hit hard by the cold and are expecting a crop reduced by as much as 80 percent in many orchards.

Unfortunately, several late growers in Washington have told me, based on their measured bud kill, they can already determine that those high-elevation, late orchards will not have enough fruit to constitute a harvest.

The good news is that we are on track to have a fairly normal crop in our early and midseason orchards — which means we can expect lots of Northwest cherries in both June and July. Growers in Oregon and Idaho are also predicting a fairly normal crop size in early, mid and late orchards. Bloom has been productive with optimal weather for bee activity and pollination.

Of course, this is the sweet cherry business, and there will always be unique circumstances to every season. This year, it appears that the California industry has set a large crop of fruit. This scenario is a bit surprising, as California had a large crop in 2023 and historically has not had two large crop years in a row.

As most of us painfully remember, the 2023 crop out of California was three weeks later than normal, and they shipped fruit well into July. As the Northwest crop compressed heavily, having both industries peaking in the same window made for a challenging market with a significant excess of sweet cherries available in June and early July.

The bright spot for this year is that California is on a more normal production timing path; they are expecting to begin harvest during the last week of April and will have a large portion of their crop available during the last two weeks of May — allowing them to cover Memorial Day ads (which they were not able to do in 2023).

With a larger California crop on the way, we will have both domestic retailers and worldwide importers focusing on heavy promotion activity in both June and July. Cherries are the No. 1 dollar-per-square-foot item in the produce department in this window, and there is great hope that the promotions and price points needed to effectively move our crop will become a reality this year.

—by B.J. Thurlby

Leave A Comment