When analyzing apple sales data from the past year, Category Partners CEO Tom Barnes found a couple of surprising trends. For the first time in at least five years, Honeycrisp retail volume declined in 2022, by about a percentage point. Even more surprising, Red Delicious volume increased by about 5 percent, after years of decline.

“Now, does that mean that we should chop down half of our orchards and start growing more Red Delicious? Absolutely not. Please do not do that,” Barnes said.

Barnes spoke during Outlook 2022, the U.S. Apple Association’s annual crop forecast held in Chicago. Rather than planting more Red Delicious, he recommended a more flexible pricing strategy for the apple industry, one based not just on supply but on what consumers want.

Satisfying consumer wants is an important consideration right now, because consumers are having a hard time. Housing, gas and food prices are high. People are not eating at restaurants as often and are buying cheaper items at the grocery store. It’s no wonder they bought more Red Delicious and less Honeycrisp, he said.

Barnes and other conference speakers discussed the challenges — including the uncertain economic outlook, farm labor shortages and a supply chain still scrambled from the pandemic — that have been squeezing the apple industry in recent years.

Federal Reserve Bank of Chicago Vice President Leslie McGranahan said the economy is sending two very different signals. Unemployment is down and wages are up substantially, but they haven’t kept up with increases in the cost of living. Consumer confidence is weak, and, even though commodity and gas prices have ticked down a bit in recent months, the near future is “very much a mystery.” New COVID-19 waves and continued fallout from Russia’s invasion of Ukraine are just two of the major issues that could continue to buffet the global economy, she said.

Meanwhile, the cost of farming keeps climbing, said Chris Gerlach, USApple’s director of industry analytics. Crop insurance claims have risen considerably over the past few decades, while the employment situation in domestic apple orchards has become “pretty dire,” with more growers relying on the federal H-2A guest-worker program. In 2012, more than 100,000 H-2A visas were issued. By 2021, there were 318,000 visas, an increase of more than 200 percent, he said.

Jon Samson, executive director of the American Trucking Association’s Agricultural and Food Transporters Conference, said the domestic truck driver shortage continues to grow. Prior to the coronavirus pandemic, the trucking industry was short more than 50,000 drivers. This year, the shortage reached 80,000. The industry’s workforce is aging rapidly and is not being replaced by enough young drivers, he said.

There are other supply chain problems affecting the apple industry. U.S. seaports have experienced major backups in the past couple of years, exacerbated by COVID-19 disruptions and labor shortages. The situation has improved in recent months, but perishable agricultural products remain particularly vulnerable to delays, he said.

On the positive side, Samson said the $1.2 trillion infrastructure bill passed by Congress last year provides a significant amount of money for road and bridge repair, including $350 billion for highways. It also includes the DRIVE-Safe Act, formally named Developing Responsible Individuals for a Vibrant Economy Act, which implements an apprenticeship program for aspiring truck drivers under the age of 21 (the minimum age to drive in interstate commerce).

Despite the challenges, apples remain the top dollar driver in the fruit category, responsible for 12 percent of total sales, Barnes said.

“There is no substitute for what you all bring into retail and to the consumer,” he said. “It’s really funny talking with other commodities within produce, because they all look at the apple category and say, ‘We want to be like that.’”

The apple industry’s “varietal innovation” excites consumers and should continue to be marketed, Barnes said, but he reminded the audience that branded varieties only make up about 9 percent of total apple sales. Industry standards such as Gala, Honeycrisp, Red and Golden Delicious, Granny Smith, Fuji and Cripps Pink are still responsible for the vast majority of apple sales.

“Sometimes, I worry we’re focusing so much on branded varieties that we forget where consumption really is,” Barnes said.

To boost consumption of any variety requires improved consumer outreach. The typical “display and pray” sales strategy, where you convince a retailer to put a new variety on the shelf and pray consumers buy it, is not effective in the long term, Barnes said.

Carrie Mack, a Walmart senior sourcing manager for apples and pears, recommended growers take greater advantage of social media platforms such as TikTok and Instagram. When consumers get excited about a new apple variety these days, they share that excitement with friends on social media, she said.

Apple growers have great stories to tell, stories that consumers want to hear, but they need to do a better job of telling them, Mack told the USApple audience.

“You have no idea how special your stories are,” she said.

More direct consumer outreach is crucial, Barnes said, because shelf space isn’t getting any bigger. The supermarkets, supercenters and warehouse clubs that sell most apples have not built many new stores in the past couple of years. E-commerce sales, after a pandemic-driven spike in 2020, declined in 2021 and are back on their previous growth trajectory. Online grocery sales have great long-term potential, but the perishability of produce poses some unique problems that still need to be solved, he said.

—by Matt Milkovich

USApple crop forecasts

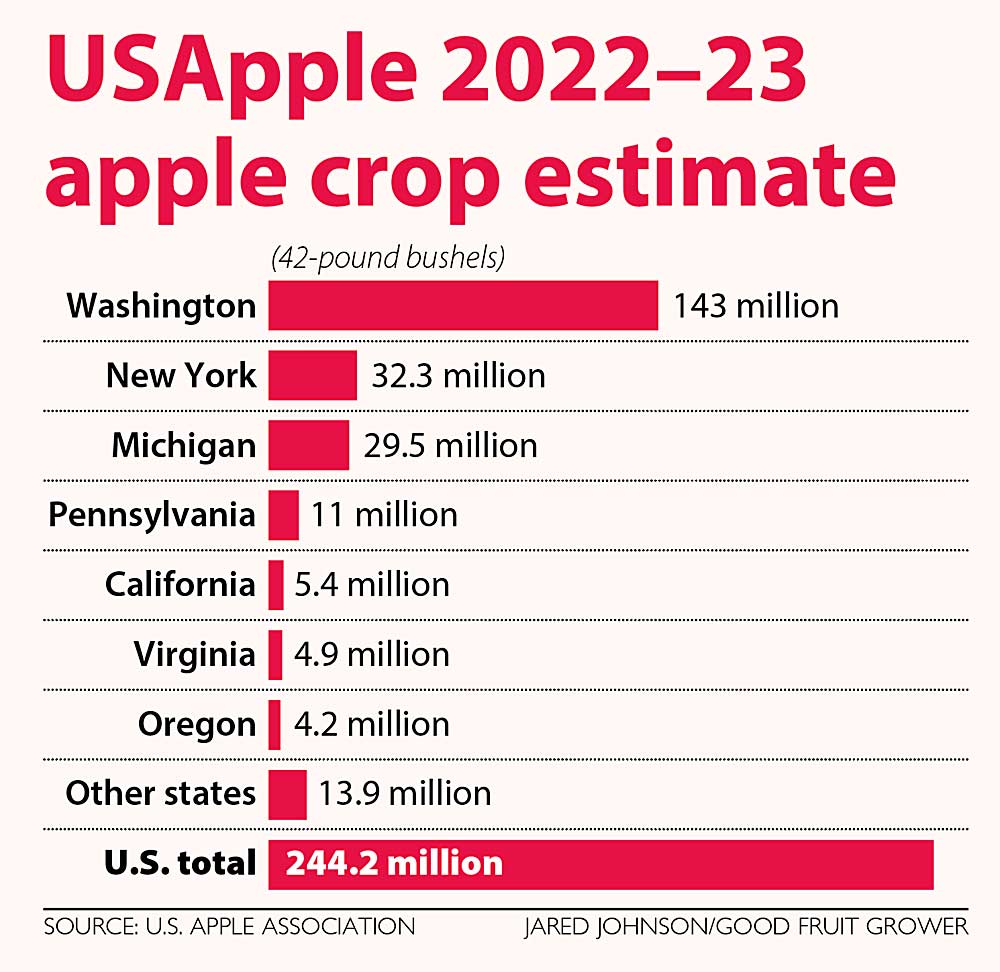

The U.S. Apple Association estimates that U.S. apple production will reach 244.2 million bushels in 2022, 1.7 percent smaller than the previous crop.

Chris Gerlach, USApple’s director of industry analytics, also shared some international estimates for the coming apple crop:

By far the world’s largest producer, China’s 2022 production is estimated to be 1.9 billion bushels, a decrease of almost 500 million bushels (20 percent) from 2021.

Europe predicts 639 million bushels total, up 1 percent from 2021. Of Europe’s top-producing countries, Poland expects 236 million bushels, up 5 percent from last year; Italy 113 million bushels (up 5 percent); France 77 million bushels (up 6 percent); and Germany 56 million bushels (up 6 percent).

Turkey, growing swiftly, predicts 244 million bushels, up 6 percent from 2021 and roughly equivalent to the U.S. estimate.

In South America, Chile predicts 66 million bushels (down 3 percent from last year); Brazil 56 million bushels (down 15 percent); and Argentina 26 million bushels (down 6 percent).

In North America, Mexico expects to produce 43 million bushels of apples, up

11 percent from last year. Canada predicts 19 million bushels, up 1 percent from last year.

—M. Milkovich

Leave A Comment