It was a tale of two harvests for Washington juice grape growers.

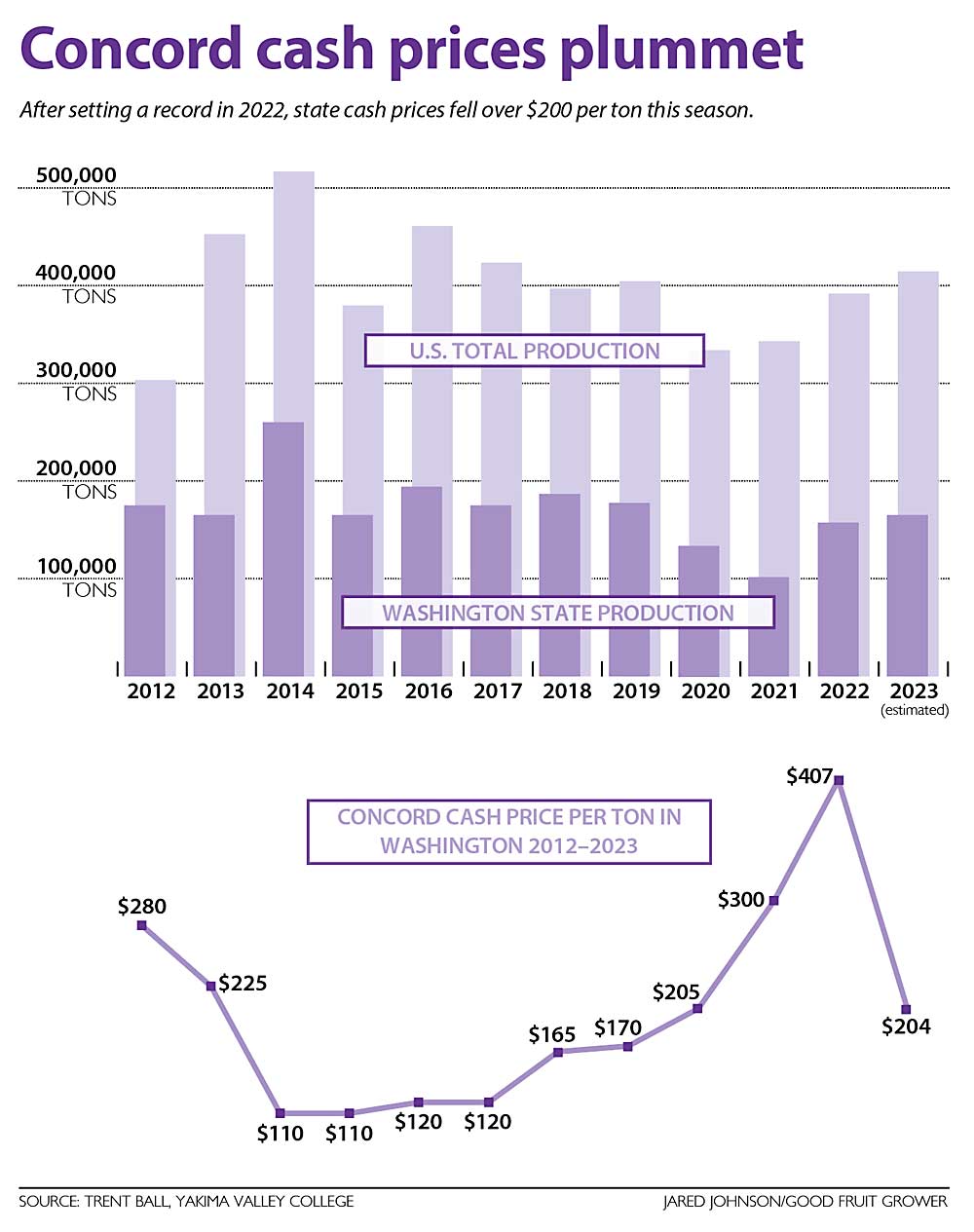

Concord growers went into the season optimistic after strong prices for the 2022 crop. But some of the region’s processors dropped their prices dramatically, pulling down the weighted average cash price from $407 per ton in 2022 to $204 per ton in 2023.

Those estimates, shared by Trent Ball of Yakima Valley College during the Washington State Grape Society’s annual meeting in November, don’t reflect the prices received by growers in the National Grape Cooperative, which accounts for some 60 percent of the state’s volume.

Welch’s growers — as the cooperative’s members usually refer to themselves — who spoke to Good Fruit Grower say they expect strong prices.

“Right now, things are looking good. We’re Welch’s farmer-owners and we feel like the outlook is stable,” said Piper Hale, co-owner of Hamley Hale Farms in Wapato, Washington. As stable as you can feel in agriculture, he added, citing the cooperative’s efforts to limit overproduction.

The cash price estimate Ball shared is a volume-weighted average based on Eastern Washington’s other processors: Milne Fruit, the J.M. Smucker Co. and FruitSmart. None of the processors returned calls for this story.

“It’s the largest spread I have ever seen before with Washington processors. Usually they are very close,” Ball said. “I can’t really explain it.”

It’s unclear from the usual economic indicators why the cash price fell so dramatically, Ball said. The cash price in the Eastern growing regions held around $400.

“It’s not uncommon that the East is higher than the West, but the gap is dramatic this year,” he said. “It’s not surprising that cash prices came down, because we’ve had four years of rising production. Cash price should come down some, but not the level of decrease that we witnessed.”

Washington harvested its largest crop since 2019, at an estimated 165,000 tons, and the rest of the country harvested a substantial crop as well, with total production estimated at 415,000 tons, Ball said. That’s the highest total production since 2017.

Ball also examines concentrate inventories across the U.S., to better understand pricing trends. Some processors are sitting on a lot of inventory while others, especially in the East, have low inventories.

Prices for U.S. Concord concentrate — which drives the market — dropped from $18 a gallon in Washington in 2022 to $14 or $15 a gallon in 2023, Ball said.

Washington’s acreage has held relatively steady, around 16,000 acres, after growers started removing blocks in response to price drops driven by oversupply a decade ago.

The Concord market is “very inelastic,” said Dick Boushey, a grower who recently retired from the National Grape Cooperative’s board of directors. “We know how much quantity we can take in and return these high prices, so we’re trying to balance that fine line.”

Several years ago, the cooperative bought out acreage from its members, to correct the supply— a difficult move at the time, but one which is now paying off, Boushey said. And with the Washington wine industry’s current oversupply, many growers who produce both juice and wine grapes are now viewing the Concord market as more stable, he said.

“It’s good to have these right now,” said Marcus Miller, a Welch’s grower and owner of Airfield Estates Winery in Sunnyside. “My banker used to be like, ‘Why aren’t you ripping them out?’ But now we see the benefit.”

—by Kate Prengaman

Leave A Comment