The first day of the 2019 Apple Crop Outlook & Marketing Conference is a wrap.

Randy Riley, director of produce merchandising for The Kroger Co., gave the opening presentation. Though positive in general, his talk didn’t paint a rosy picture for the U.S. apple industry. He said U.S. apple consumption has shrunk by 11 percent in the last five years.

“Apples continue to lose meaning nationally,” Riley said. “The question is why.”

He gave four reasons.

1) Internal competition. Retailers think there are too many apple varieties to choose from, so imagine what it’s like for consumers. The industry hasn’t done enough to remove inferior apples from the market as new, superior varieties move in.

“At the end of the day, the customer is confused,” Riley said. “They are not the experts we think they should be, nor will they ever be.”

2) External competition. In other words: other fruit. Riley mentioned Cutie oranges and Cotton Candy grapes as examples of effective marketing strategies that the apple industry should emulate.

“You are losing your customer to these other categories,” Riley said.

3) Emerging trends. Like fad diets. Some of these diets are apple-friendly, however, and the industry should capitalize on them. Another disturbing trend: Millennials don’t eat as many apples as Baby Boomers.

4) Political tension. Reports of tariffs and trade wars, as well as mergers and acquisitions in your industry, cause confusion and concern for customers, Riley said.

To fight these negative trends, he recommended an increased focus on what the customer wants. This means more engaged marketing, innovation in things such as packaging, and cutting out the dead weight (such as Red Delicious).

“You folks have to do a better job marketing yourselves to the consumer,” Riley said.

Fortunately, the apple industry has built-in advantages.

“You have crunch, which your competition does not,” he said. “You have different taste profiles. You have value. You have shelf life.”

Riley was followed by Mark Seetin, director of regulatory and industry affairs for the U.S. Apple Association. Seetin discussed various aspects of the 2019 apple crop. Here are a few of the points he made:

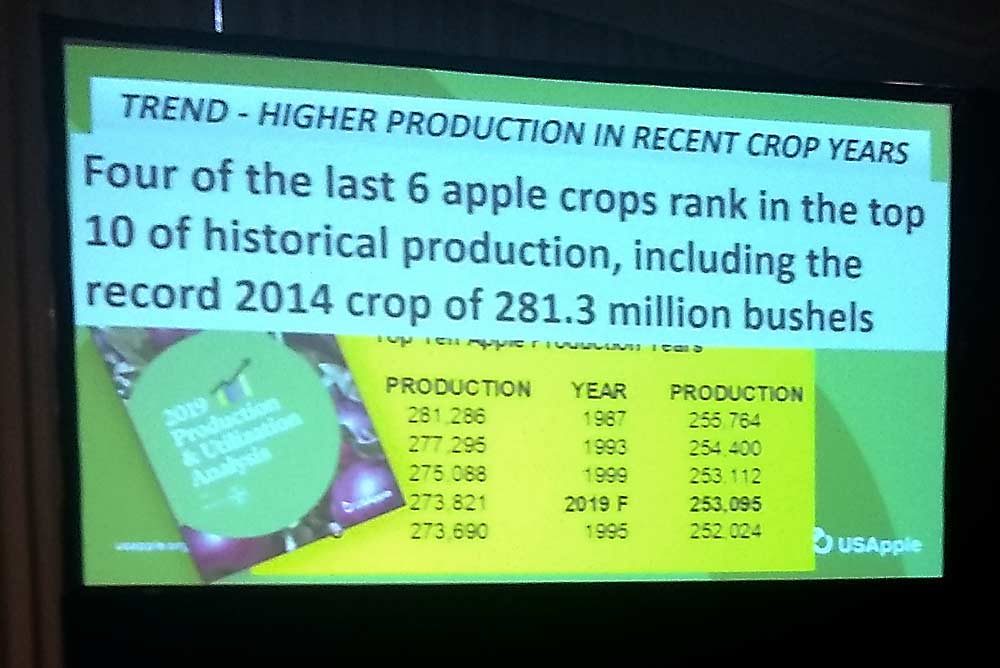

—USDA’s forecast of the 2019 U.S. crop, made in early August, was 253.1 million bushels. That would be the ninth largest crop in history.

—The industry continues to get more production out of fewer acres, a dramatic increase in productivity.

—USDA purchased $83 million in fresh apples in 2019 to offset the damage done by trade wars.

—The industry is growing 10 to 12 million more bushels of Red Delicious than the market can accept. (However, Red Delicious makes up about 50 percent of exports.)

—Honeycrisp production will most likely surpass Granny Smith in 2019 and could very well surpass Fuji next year, which would move it into third place.

—Red Delicious and Golden Delicious made up 57 percent of the market in 2000. In 2019, they’re at 25 percent, and still going down.

Michael Choi, president of Zhonglu America Corp., said that after an unprecedentedly bad year in 2018 (due to bad weather), China’s apple crop will be back to normal in 2019: 43 million metric tons.

Fresh consumption makes up about 85 percent of China’s crop. The country’s biggest export markets are Bangladesh, Indonesia and Russia, Choi said.

—by Matt Milkovich

Leave A Comment