Pears face more competition than ever in the produce section, so the Northwest pear industry believes it must deliver a high-quality Anjou that’s ready to ripen in a just few days in order to rebuild consumer demand and prices for the fruit.

But two proposals for self-regulation to prevent hard, green pears — fresh off the tree and unlikely to ripen well — from disappointing consumers remained a controversial topic when the Fresh Pear Committee met in late May.

It took several votes, but the committee ultimately opted to put slightly stricter quality standards on early season Anjous in the industry’s marketing order. The change marks just one piece of a complex effort to rebuild a floundering Anjou category beset by trade challenges, inconsistent quality, rising costs of production and declining returns in recent years.

Many of the industry’s leading voices say it didn’t go far enough.

“It’s a step in the right direction,” said grower and committee member Dane Klindt. “I’d like to think they looked at the data and saw that, scientifically, it makes sense. We understand how to put a ripenable pear on the market.”

He helped to develop the recommendations based on Pear Bureau-commissioned research from the 1980s, which demonstrated the relationship between Anjou pressure at harvest and the time the fruit needs to spend in cold storage to trigger the ripening process.

The approved changes would lower the firmness standards for fruit entering the market before Nov. 1, from 14 to 13 pounds, and eliminate a loophole that allowed shippers to each move 8,000 pounds of fruit exempt from the standards. The marketing order already specified that fruit needs to have a core temperature at 35 degrees or less and pressure test of 14 pounds or less to be marketed before Nov. 1.

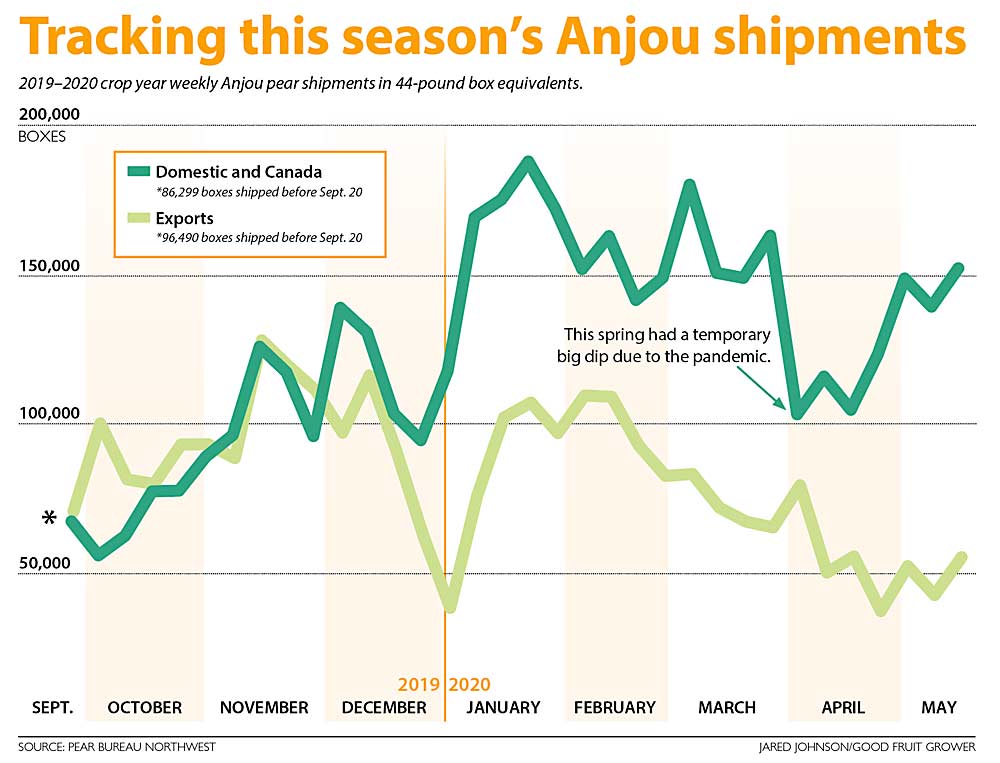

Graphic: Jared Johnson/Good Fruit Grower)

Many growers who spoke at the meetings preferred a second proposal, which would have also prevented any Anjou sales before Oct. 1, to ensure fruit has enough chilling time to trigger ripening before it hits the market. Shippers from earlier districts, such as the Yakima area, said this would put them at an unfair disadvantage, forcing them to hold off on sales even if their fruit was ready to ripen.

But research shows that a 13-pound pear still needs almost a month in cold storage to reach optimum quality, so those first sales after harvest are still likely to pose quality concerns, said Ken Hemberry, manager of the Peshastin Hi-Up Growers. His colleague, Randy Talley, offered the committee’s only vote against the first proposal the second time around, taking a stand that it didn’t do enough to solve the problem at hand.

“We’re just trying to do what’s in the best interest of our growers, and without the chill time, it’s not gaining much of anything,” Talley said. Hi-Up Growers hasn’t sold any Anjou into the domestic market before Oct. 1 in the past couple of years, Hemberry added, and neither has their marketing partner, Stemilt Growers.

Those early season shipments of hard green pears “poison the market” for the rest of the fruit the industry wants to ship during the season, said Mike Taylor, Stemilt vice president of sales and marketing, at the committee meeting. “The spirit of both these recommendations is not to harm our markets.”

In a small taste test survey conducted by the Pear Bureau, more than 50 percent of consumers gave Anjous sold before Nov. 1 a “yuck” rating, and another 25 percent received a “bland” rating. That’s a huge problem, said grower Yesenia Sanchez Oates.

She and other family pear farmers in Oregon and Washington have recently organized to advocate for more rigorous fruit quality standards they believe are necessary to keep growers in business.

“We work all year to grow a quality product, to have it mishandled,” she said. She called the marketing order change incremental progress that doesn’t go far enough fast enough as growers face bankruptcy. “You can’t be disappointed in a step forward, but we’re still in a big mess.”

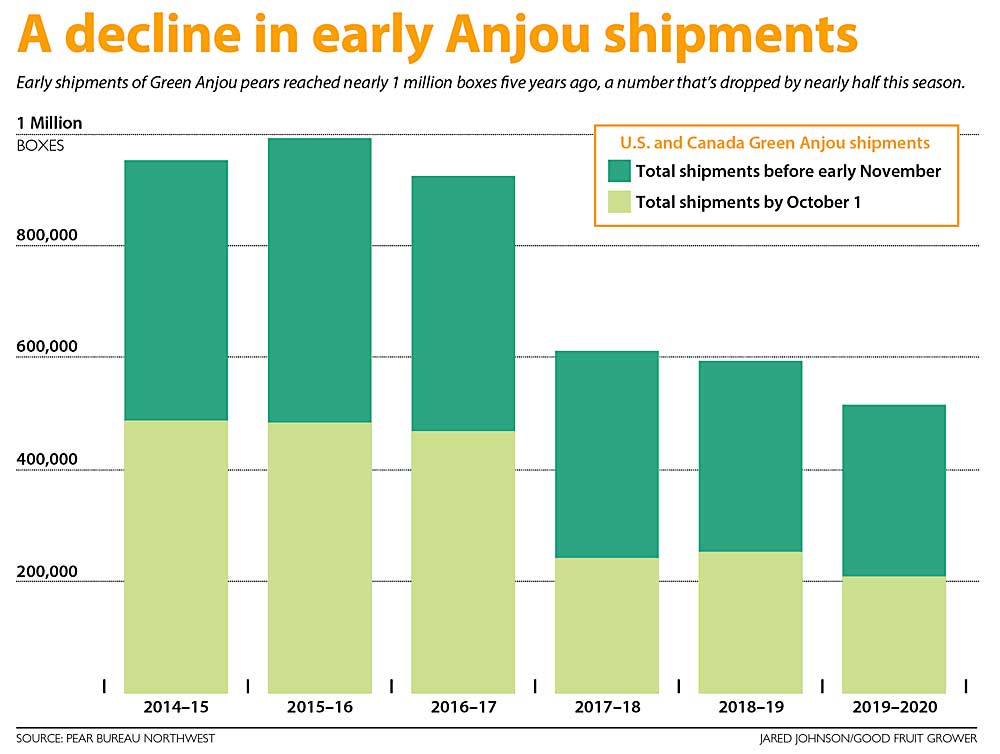

Graphic: Jared Johnson/Good Fruit Grower)

Many who supported the proposal to limit domestic sales entirely before Oct. 1 — which accounted for about 5 percent of the 2018–2019 crop — hope the issue will be brought before the industry again.

“This is not the finish line, it’s just the first step in the journey,” said Ed Weathers, president of packer Duckwall Fruit and chair of the Fresh Pear Committee.

He said the approved changes to the marketing order mean shippers will have to hold fruit an additional seven to 10 days to go from 14 pounds to 13, so the regulation shouldn’t pose a significant burden. Perhaps more impactfully, at harvest, “it means we will put more of those 14-pound pears where they belong, in long-term CA storage,” he said.

The Pear Bureau data on fall Anjou shipments show that the industry was already on its way toward reducing the sale of fruit in September and October. From 2014 to 2019, shipments before early November have fallen by almost half.

Sanchez Oates said she and other growers met with Walmart’s pear buyer last year to talk about quality issues and learned that the company — the nation’s largest pear retailer — no longer plans to take shipments before Nov. 1.

Moving away from the earliest shipments and conditioning pears with ethylene to encourage more consistent ripening has resulted in great feedback on fruit quality, Hemberry of Hi-Up Growers said.

“We believe Anjou pears are the best eating fruits on the planet, but they are more complicated,” he said. That’s why the industry needs collective action through the Pear Bureau and the marketing order to unite the industry around a focus on quality, he said.

“I’m watching all these apple varieties, these clubs, they are very protective of eating quality and consistency. As a pear grower, I want to do everything I can to protect the pear industry like everyone up north is doing to protect their apple varieties,” Klindt said. “We’ve got a lot of people working hard to put a good product on the market. I just hope everyone is.” •

—by Kate Prengaman

Related:

—Pear industry ripe for a rescue

Leave A Comment