The Russian invasion of Ukraine is not just a humanitarian and political crisis, it’s also an agricultural one.

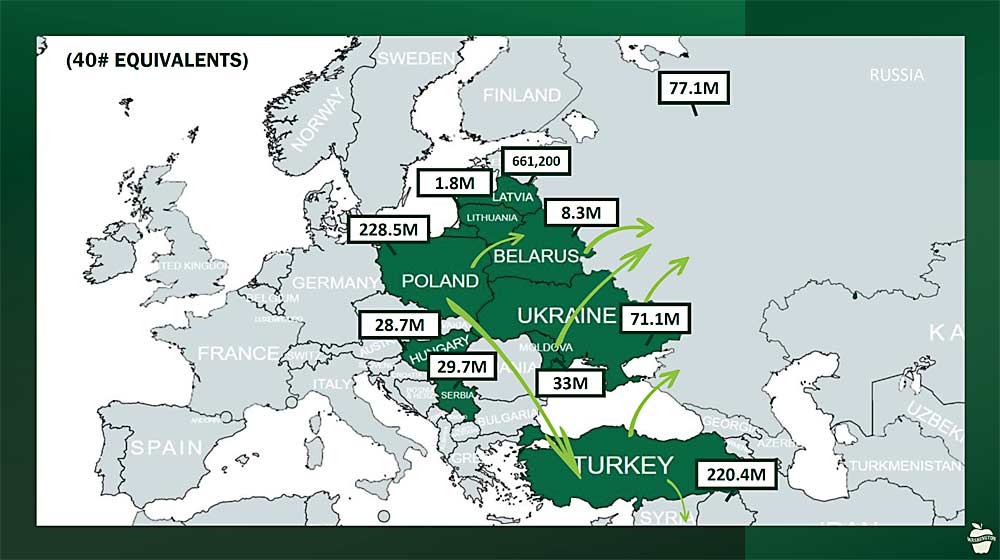

Ukraine is one of the world’s top grain exporters, and its neighbors include some apple production leaders, including Poland and Turkey.

“This is going to have a major impact across Europe and Africa,” said Todd Fryhover, the president of the Washington Apple Commission, speaking to his board at a meeting on March 3.

When it comes to the global apple landscape, Fryhover pointed out that Poland, the world’s No. 3 producer, historically exported much of its crop to Russia. Now, it’s looking for new markets at a time when the European Union as a whole has an abundance of apples, thanks to an exceptionally large crop in 2021.

“For the first time ever, I heard Poland say they have unsaleable fruit,” Fryhover said, sharing updates from a recent World Apple and Pear Association meeting.

The ripple effect from that, he continued, is that South American exporters, looking at the situation in Europe, may turn their attention to the more stable U.S. market. “They may be talking to your retailers,” Fryhover said.

In light of that, the global shipping and logistics challenges appear to be both a blessing and a curse, said board member James Foreman of Foreman Fruit Co. It’s helping to protect the domestic apple market perhaps more than it’s hampering U.S. exports.

And in this context, the apple commission’s “home court” approach looks even better, Fryhover said. The commission has increased its emphasis on Canada and Mexico in the past few years, pulling back in offshore markets such as India, where tariffs and other challenges have drastically reduced exports.

“We’re seeing some tremendous increases in the cost of getting our product overseas,” Fryhover said.

The offshore markets that are positive include Taiwan and Vietnam, both of which want higher-value fruit, but not at high volumes.

From there, the commission’s board members discussed their outlook for the 2022 crop. No one expects the industry to hit a 140 million-box fresh market crop — or welcomes the idea. The 2021 harvest is estimated at 118 million boxes, down from about 134 million in 2019 and 2020.

“I don’t know how we could price a 140 million-box crop to sell it with declining exports and rising costs of production,” said Jim Hazen of FirstFruits Farms.

“I think 120 million to 130 million is where we are going to need to be to match supply with demand,” said Mark Stennes of Stennes Orchards.

Around the room, board members agreed that the planting boom from several years ago has halted, although lots of young orchards are still coming online, and they encouraged the industry to continue to pull out underperforming blocks such as older Reds and undercolored Fujis.

—by Kate Prengaman

Leave A Comment