In many ways, apples are still the envy of the produce aisle.

They command a larger share of total dollars (11 percent) than any other fruit in the produce category, according to market research company Category Partners.

And the sheer number and diversity of varieties gives apples a distinct character that other fruits lack. Traditional varieties have built strong customer loyalties over the years, while new releases create excitement and attract new customers.

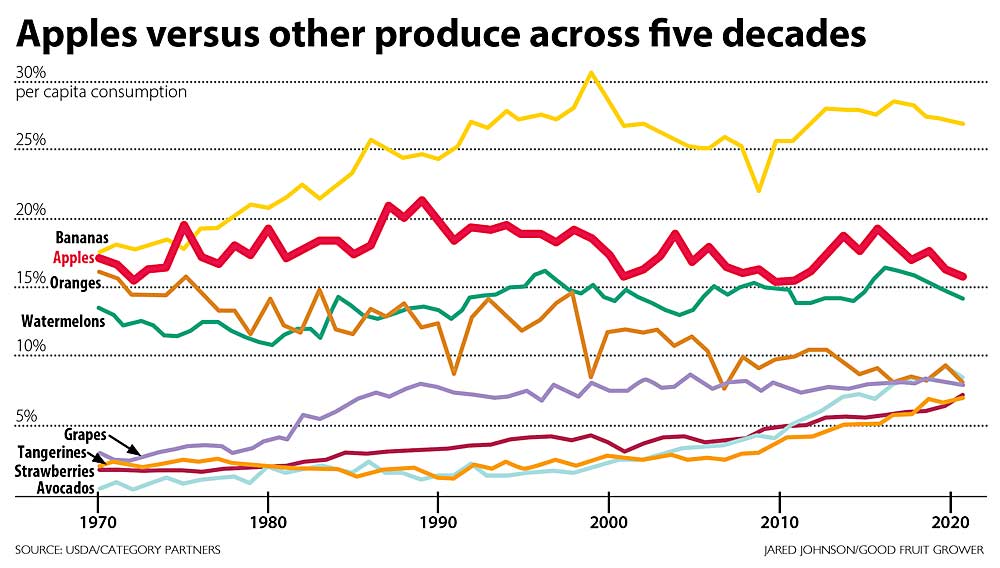

But despite those strengths, growing competition from other fruits, the rising cost of doing business and customer reactions to inflation threaten the apple’s command of produce purchases. (Bananas have led per capita consumption for decades, but not total dollars.)

Speakers discussed the state of apple sales at the U.S. Apple Association’s Outlook 2023 conference in Chicago in August. Cara Ammon, senior vice president of research and market intel for Category Partners, said that even though apples are selling for higher prices than they were a year ago, much of that increase is due to inflation. In the same period, apple volume and per capita consumption decreased.

And the cost of growing apples continues to go up.

Since 2020, apple prices have risen 24 percent, while the cost to produce them has increased 62 percent. Much of that has to do with the rising cost of labor, said Chris Gerlach, USApple’s director of industry analytics.

According to surveys conducted by Category Partners, most consumers are concerned about inflation and believe it will last at least another year. Two-thirds of consumers now shop for groceries on a budget. They’re buying less produce, looking for sales, using coupons, switching brands and cooking at home more often, Ammon said.

The recent decline in apple consumption is part of a longer-term decline over the past three decades. Much of the decline in apple consumption has to do with price and increasing competition from other fruit categories, she said.

How to reverse that trend and increase apple consumption is the challenge.

Price always represents the most important factor. More than half of consumers say they would buy more apples if prices were lower, Ammon said.

But there’s more to it than price. Meghan Diaz, senior director of local and regional produce at Sprouts Farmers Market, a supermarket chain based in Phoenix, Arizona, told the USApple audience that even though consumer eyes automatically look at the dollar sign, that’s not all they’re looking at.

“Most of our customers are looking for quality, consistency and reliability, not just affordability,” Diaz said.

Sprouts chooses to display products that provide some type of service to the customer. Flavor and eating experience are crucial. So is quality.

To drive more consumption, don’t focus too much on market dictates, Diaz said. Create demand rather than fight over it. There’s a danger to focusing too much on price, on simply selling apples cheaper than your competition.

“There’s already enough people out there competing on price point,” she said.

Produce marketing often focuses on health, wellness and nutrition, but apple growers’ greatest promotional asset might be their own stories.

“Every grower I work with has really great stories about multigenerational struggles and family traditions,” she said. “Customers need to know those stories. They need to see your passion.”

Sprouts relies more on in-store and digital marketing to tell those stories. The chain also touts its sustainability initiatives, such as using less plastic and more paper packaging. Explaining those kinds of initiatives to customers is key — as is not raising prices too much.

“Where it gets kind of sideways is where we dive too far in, and the customer pays for all of those choices and doesn’t necessarily understand why,” Diaz said.

Ammon said the industry needs to better communicate new flavor profiles. Even though the great number of apple varieties can be a source of strength, they also can overwhelm consumers. She recommended promoting apples for multiple eating occasions — as part of a healthy breakfast or as a healthy side for a meal, for example.

To win the loyalty of the next generation of apple buyers, the industry must continue to provide both loose and packaged apples. A slight majority of consumers still prefer loose apples, but bagged and other packaged apples are increasingly popular. Younger consumers and consumers with children like the convenience and availability of bagged apples, Ammon said.

—by Matt Milkovich

USApple 2023–24 apple crop estimates

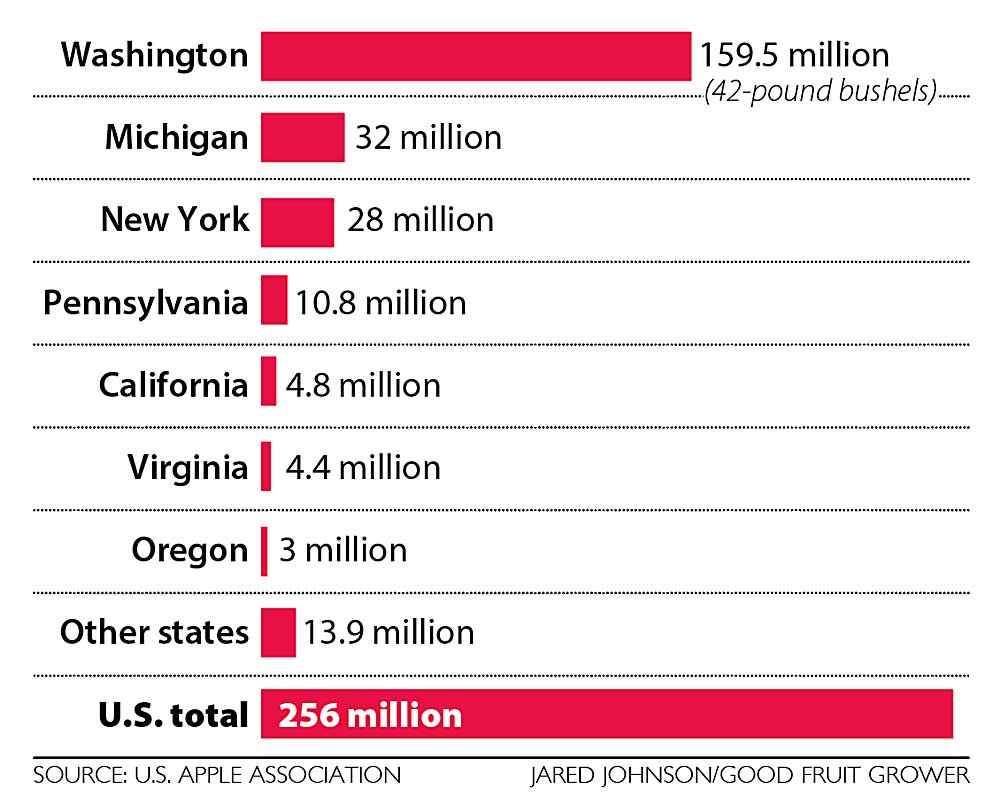

The U.S. Apple Association estimates that U.S. growers will produce 256 million 42-pound bushels of apples in 2023, up 4.1 percent from last year’s crop.

In the West, Washington state’s estimate is 159.5 million bushels, up 9 percent from last year. California’s estimate is 4.8 million bushels, up 14 percent. Oregon’s estimate is 3 million bushels, down 8 percent from last year.

Farther east, Michigan will produce 32 million bushels, down just 1 percent from last year’s record crop. New York will produce 28 million bushels, down 13 percent from last year. Pennsylvania’s estimate is 10.8 million bushels, up 9 percent. Virginia will produce 4.4 million bushels, down 1 percent. Remaining states will produce 13.9 million bushels, up 1 percent from last year.

International estimates

USApple estimates China’s 2023 production will be 2 billion bushels, an increase of 3 percent from 2022.

Turkey, swiftly increasing its production, will produce 241 million bushels in 2023, up 2 percent from last year.

European production is estimated at 612 million bushels, down 3 percent from last year. Poland will lead with 210 million bushels (down 11 percent from last year), followed by Italy with 110 million bushels (same as 2022), France with 79 million bushels (up 8 percent) and Germany with 50 million bushels (down 11 percent).

In South America, Chile will produce 63 million bushels (down 1 percent from last year). Brazil will produce 60 million bushels (up 15 percent) and Argentina 28 million bushels (up 9 percent).

In North America, Mexico will produce 42 million bushels (down 1 percent from last year) and Canada 19 million bushels (down 5 percent).

—M. Milkovich

Leave A Comment