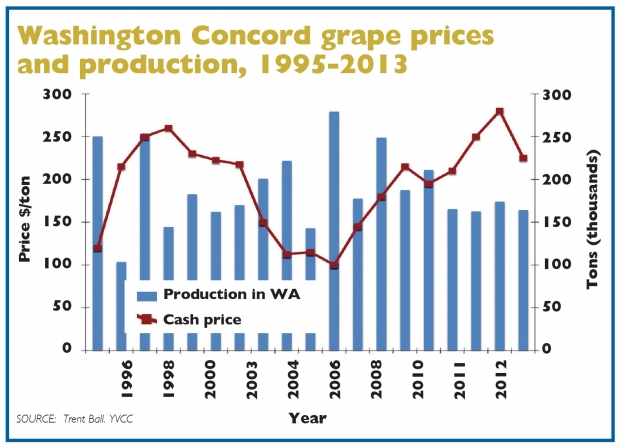

Washington Concord grape prices and production, 1995-2013. Source: Trent Ball, Yakima Valley Community College.

Washington State’s juice grape growers are feeling pretty good following a successful 2013 harvest and record cash prices last year. But with the big 2013 crop picked on the East Coast, the high prices are coming down, says an agricultural economist.

Trent Ball, agricultural economist and director of the Yakima Valley Community College’s Vineyard and Winery Technology Program, gave his take on the 2014 outlook for Washington’s wine and juice grape industry during the Washington State Grape Society’s annual meeting in Grandview, Washington. “To look forward, you have to look back,” he said, explaining that previous grape crops have an impact on future ones.

The weather cooperated during harvest last fall, allowing growers time to pick grapes before any killing frost. Berry color for juice grapes was good, though size was slightly below average.

“We had a record level of heat units, measured as growing degree-days, that drove sugars up. But the cooldown in September allowed for a normal juice grape harvest,” Ball said.

Craig Bardwell of National Grape Cooperative Association said that the warm temperatures allowed “everything” to ripen. “Over all, it was an average crop in terms of yield for Washington Concords.”

The 2012 U.S. Concord crop of around 300,000 tons was one of the smallest on record since the early 1980s, Ball said. Washington’s Concord production in 2012 was average, but East Coast growers experienced damaging frost during spring, greatly reducing their crop. Juice concentrate inventories were low before the 2012 harvest.

The low supply drove up cash prices last year to a record $280 per ton for Washington Concords and $286 per ton for East Coast Concords.

2013 crop

Because Concord vines are prone to alternate bearing, the short 2012 crop in the East Coast set up the vines for a very heavy crop in 2013. Although final production figures for Washington were still being tallied at the time of his talk, Ball predicted the state’s production this year would be around 164,000 tons—slightly lower than in 2012.

“Yields in the state averaged 7.6 tons per acre in Washington in 2013 compared to 8.3 tons per acre in the previous year,” he said, adding that the average Brix level in both years was 17.6 degrees.

Washington State is the number-one juice grape producer, annually growing about half of the nation’s Concord and Niagara grapes. The state’s ten-year production average has been around 195,000 tons. While Washington had a somewhat normal year, though light in tonnage, the heavy crop from East Coast producers will have a major influence on grape juice concentrate inventories.

“Michigan averaged 11.75 tons per acre, the largest Niagara crop on record,” said Ball, noting that Michigan’s Concord production increased 60 percent compared to 2012. “New York and Pennsylvania also had high yields, and significant thinning was needed. New York’s 2013 production is estimated at 156,000 tons, up from its ten-year average of around 110,000 tons. The Lake Erie region expects to pick their largest crop on record of an estimated 225,000 tons.”

Ball said the 2013 U.S. Concord crop should hit around 442,000 tons—the largest since 2008.

With a slightly lighter crop in 2013 in Washington, Ball predicts that the 2014 Washington crop will be larger due to the cyclical nature of alternate bearing, unless weather throws a curve ball.

“When cash prices reach record levels, the only place for them to go is down,” said Ball. Instead of seeing $280 per ton in Washington, growers are seeing $225 for the 2013-2014 crop. East Coast prices also have dropped to $260 per ton, the first drop in price since 2005, he noted.

The high cash prices pressured the concentrate prices, which rose to record highs. “High concentrate prices look good on paper, but in the marketplace, it’s not such a good thing,” Ball said.

“The concentrate price got up so high in 2011 and 2012—around $20 per gallon of 68 Brix concentrate—that processors looked for other juices as a substitute. Cheap Chinese apple juice can be bought for $7.50 per gallon.”

Last year, U.S. concentrate prices dropped to around $15 per gallon.

Argentina

Imported Concord concentrate competes directly with U.S. concentrate. Since 2009, the amount of imported concentrate has ranged from around 50 to 63 million gallons, according to Ball. The majority of imported concentrate comes from Argentina, which accounts for 80 percent of the imported volume. Small amounts also are imported from Chile, Italy, Mexico, and Spain.

“Argentina had a huge crop in 2013,” he said, but added that they’ve had difficulty getting the product out of the country. “Imported Concord concentrate

is currently landing at our ports for around $8 to 9 per gallon.”

Ball explained that the reduction in the 2013 cash price was expected, along with a lower concentrate price.

Inventory of grape juice plays a part in supply and demand and determining where the Concord market is headed for 2014. A look at the numbers for U.S. production, imports, and exports gives a picture of what’s available for consumption, he said.

The latest inventory data available, based on 2011 figures, shows there were nearly 132 million gallons of grape juice available for consumption, up from 115 million gallons in 2010 and 2009.

2014 outlook

“All of these pieces—current production, inventories of product, imports, and demand—go into determining prices for the coming year,” Ball said.

“We can anticipate steady Concord acreage in Washington as there aren’t new plantings going in,” he said. However, growers in California are expected to remove another 10,000 to 15,000 acres of Thompson Seedless grapes and other grape varieties that can be made into grape concentrate.

Current inventories should be more controlled and move easier this year, he said, adding that the lower U.S. concentrate prices will be more competitive with imported product.

“You can expect the cash price for Concords next season to be similar to 2013 ($225 per ton) or slightly higher. But remember, the 2014 crop in Washington is primed to be big, while the East Coast, just coming off a big crop, should be down in yield.” •

Leave A Comment