It is imperative to know who is buying your pears, as well as where they are buying them. With this information, we can craft the right marketing message and communicate it where the customers will see it, coordinating the messaging with online shopping or in-store activities and displays that will grab the consumer’s attention. This is how Pear Bureau Northwest is using marketing funds efficiently and effectively in today’s landscape.

We know from our consumer research that the people who buy the most pears in the U.S. today are under 45 years of age. Sixty-one percent of U.S. pear consumer households are Gen Z and millennial households. Pear Bureau marketing and promotion programs have been successful in capturing the attention and buying power of these younger consumers who buy more varieties and use them in more recipes.

These consumers are active on social media, and that is where we most often reach them. We keep pears relevant with cheeky, fun and lively ads and communications that are sometimes irreverent. In this way, we have caught the attention of younger buyers — which is so important to keep growing consumption.

Pear Bureau promotions have evolved, and continue to evolve, to reach consumers where and how they shop. Our industry has directed us to continue to shift resources away from retail promotions and toward more consumer advertising and digital promotions in order to capture consumers who shop more and more online.

Online shopping is here to stay. In June 2023, online grocery sales totaled $7.1 billion in the U.S. This is up from $1.2 billion in June 2019, before the pandemic.

However, close to 70 percent of shoppers still do most, or at least some, of their grocery shopping in a store. For produce, that number is even higher, as many consumers prefer to select their own produce.

To make sure pears are well stocked in good locations in supermarkets, our team provides retailers with fact-based pear category data and information, including information on how they compare to their rival retailers. We help the retailer grow their sales and compete with their rivals using effective programs such as sampling and sales and display contests, while adding new and innovative promotions to attract consumer attention.

Consumers buy with their eyes and come back for the flavor. Having eye-catching, in-store displays of colorful pears is important to capture the attention and purchases from the 15 to 20 percent of U.S. households who likely have pears on their minds or on their lists when they go to the store, as well as capturing the impulse sales that are so important for pears and produce in general.

Retail buyers are gatekeepers, making decisions about which products they will stock throughout the year. Every year there are more and more produce items vying for the buyers’ attention. Each season seems to bring a new apple or grape variety, as well as new fresh-cut produce items, all competing for shelf space in the retail produce department. So, it remains important for our team to be calling on retailers all year around — talking pears and only pears, providing data and innovative promotion ideas and support, keeping pears well stocked on retail shelves.

We can do all of the online advertising in the world, but when consumers go into a physical store and there are no pears on the shelf, they can’t buy them. Consumers can’t buy what isn’t offered, so it is very important to continuously talk pears to the retail buyers throughout the season and ensure pears are displayed prominently in produce departments.

The bottom line is that we need to mix it up and continue to have consumer advertising, social media communications, shoppable recipes and sponsored search on e-commerce sites as well as in-store programs to grab consumers’ attention wherever and however they shop. We reach them on all the channels and screens they use to get inspired, research or shop for their produce online or in-store.

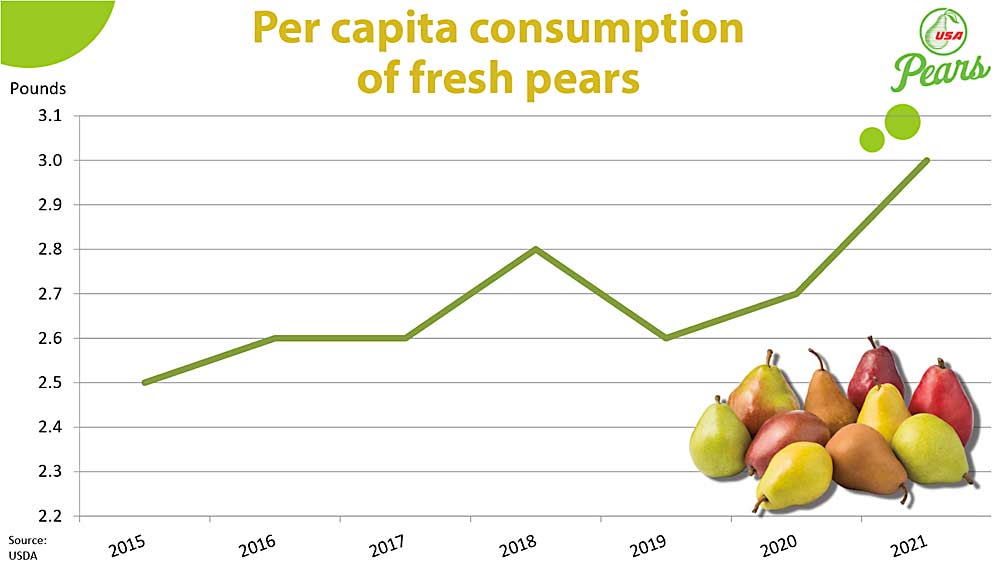

What we are doing is working. According to a 2022 econometric study by Cornell University economics professor Harry Kaiser, our retail promotion investments returned $4.80 for every $1 spent. That is a very good return on investment. Additionally, according to the latest U.S. Department of Agriculture figures (available through 2021), per capita consumption of fresh pears increased by 20 percent over the past 10 years. The data shows consumption rising from 2.5 pounds per capita in 2015 to 3 pounds per capita in 2021.

We continue to innovate and evolve, monitoring trends and research to stay relevant and provide effective, cutting-edge solutions and promotions to increase pear sales and consumption. Our team of marketing professionals at pear headquarters and in the field is dedicated to educating consumers and buyers alike about pears, increasing consumption and helping keep the pear industry healthy and profitable.

All pears, all the time.

—by Kevin Moffitt

Leave A Comment