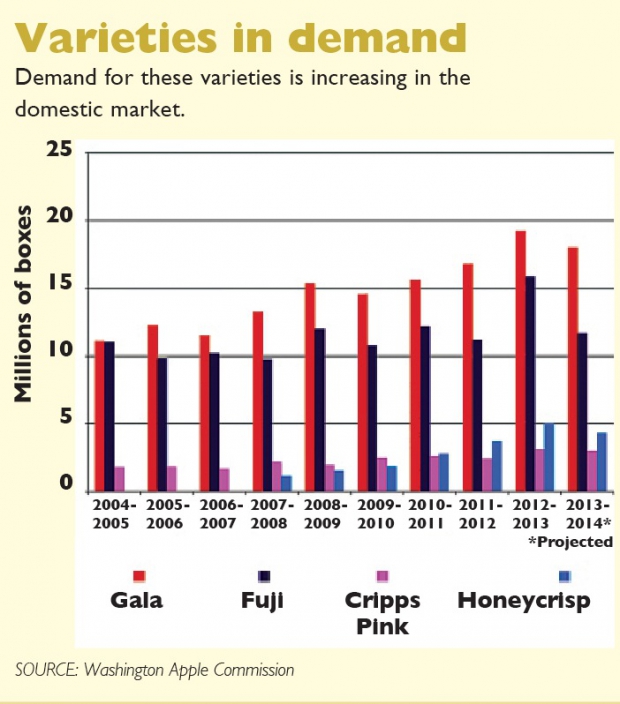

A transition to newer, more appealing apple varieties is helping Washington growers to sell larger crops at strong prices and giving marketers reason for optimism, even as apple production increases.

A transition to newer, more appealing apple varieties is helping Washington growers to sell larger crops at strong prices and giving marketers reason for optimism, even as apple production increases.

“We’re on the cusp of seeing an increase in per capita consumption of apples,” Todd Fryhover, president of the Washington Apple Commission, told the Good Fruit Grower.

“We have a taste and texture for everybody, and better quality. These new apples are firm and taste good, and orchard and warehouse practices have improved dramatically in the last ten years.”

Washington State produced a record fresh apple crop of 129 million boxes in 2012. That was 20 million boxes more than the industry had ever sold before. About 15 million boxes of that additional volume went to the domestic market, which normally takes about 70 million boxes of Washington apples, and 5 million went to export markets.

Because of light production in the East and Midwest, Washington was able to sell the record crop at record prices.

Of the 15 million boxes that moved to the domestic market, two-thirds were varieties other than Washington’s flagship Red Delicious, Fryhover points out. There were more Gala, Granny Smith, Honeycrisp, Cripps Pink, Fuji, and club varieties. F.o.b. prices were high because U.S. retailers sold more fruit and made more money on them than they ever have before, he said.

“The numbers aren’t the complete story,” Fryhover said. “There’s something else going on out in the marketplace, and I think it’s just getting better fruit into the hands of U.S. consumers.”

(Aurora Lee/Good Fruit Grower illustration)

2013 crop

In 2013, Washington producers were initially expecting another crop of more than 120 million, which, with full crops in other areas of the country, would push a record volume of apples onto the market. But the crop came in at 113 million boxes and could end up shorter still because of lower packouts than usual attributed to hot weather in late summer.

By the end of January, 43 percent of the crop had been shipped, compared with 40 percent at the same time during the 2011-12 season when Washington shipped 109 million boxes. And prices for most varieties (with the exception of Red Delicious) were higher than two years ago.

Export volumes have been similar to two years ago and look set to reach 36 million boxes for the season.

Fryhover said Washington growers have been able to react to changing consumer preferences relatively quickly. They are not afraid to plant 1,000 acres of a variety at high densities.

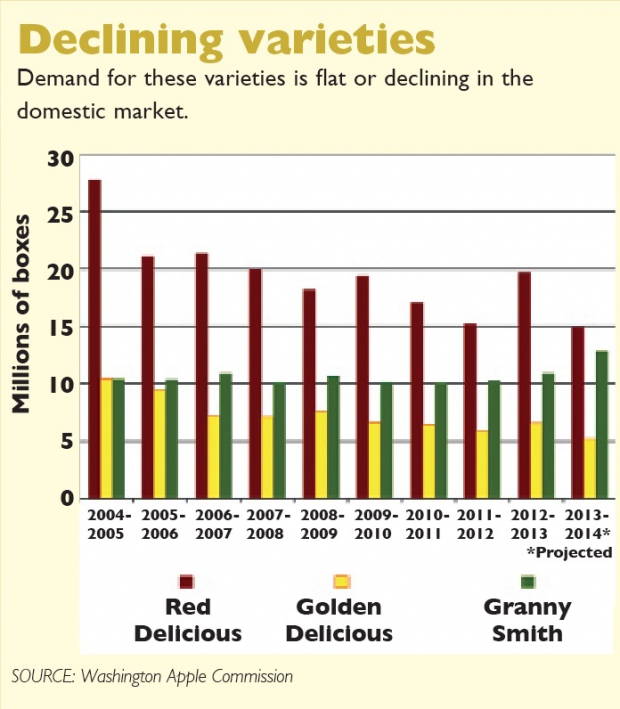

However, it takes time to replant an orchard and bring it back into production, which means that as the domestic market takes more new varieties, it will push more traditional varieties, such as Red and Golden Delicious, into export markets.

“That creates a dilemma in the short term,” Fryhover said.

Although Red Delicious has been shrinking as a percentage of the total crop, the volume has been stable at around 35 million boxes annually for the past decade. Fryhover said the variety still holds some appeal for producers. It’s easy and cheap to grow, easy to pack, and it holds up well to shipping and handling.

(Aurora Lee/Good Fruit Grower illustration)

Even at lower f.o.b. prices than other varieties, it can be still be profitable. And even Red Delicious is better quality than it used to be because of better postharvest practices and use of MCP (1-methylcyclopropene).

Fortunately, in some markets, the Washington Red Delicious apple is still iconic, and it’s a variety not grown in many other places. It’s one of the major varieties exported to India. “Compared to their domestic production, a Red Delicious from Washington is a bullet,” Fryhover said, noting that it holds up well to 80-degree temperatures and 80 percent humidity.

Fryhover said it’s been forecast that Washington could produce a 140-million-box fresh crop by 2016 and Michigan and New York could produce 30 to 40 million boxes each. That means Washington will have to try to move another 20 to 30 million boxes into foreign markets.

Bullish

But he’s feeling bullish. “As we see our crops grow and we continue to have better-tasting varieties, we can compete with anybody in the world,” he said. “Absolutely no problem.”

Big jumps in production will not have the impact that they did back in the 1980s and 1990s when the industry was focused primarily on one variety, Red Delicious, he said.

“That diversification on the varietal side lends a lot of stability in the marketplace,” he said. “We may see some suffering in some of the traditional varieties, but with the varieties that consumers have proven they enjoy, I think we’re fine. People are getting used to paying $1.99, $2.99, $3.99 a pound for apples.” •

Leave A Comment