Photo by Melissa Hansen

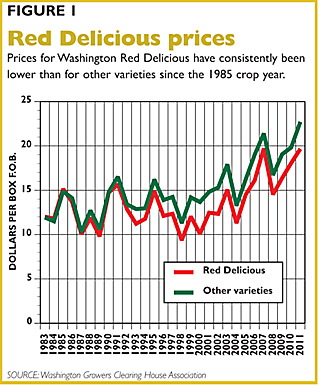

For the past 30 years, Red Delicious has been the poor relation of the apple family. Although all varieties of apples have been profitable in recent years, Red Delicious is still close to the bottom of the list in terms of f.o.b. prices.

Last season, the average return on Washington Red Delicious apples was $19.66 a box, according to the Washington Growers Clearing House Association, while the average for all varieties was $22.71.

So, why would a grower plant Red Delicious apples rather than Honeycrisp, which fetches more than twice the price?

First of all, there’s market demand. Red Delicious is still Washington’s top-selling apple variety, accounting for just under 30 percent of the crop. This year’s production is estimated at 32 million boxes.

Secondly, it is easy and economical to grow, says Mike Robinson, production manager at Double Diamond Fruit Company in Quincy, Washington. Growing Red Delicious requires relatively little infrastructure and equipment, and a small crew.

Plus, harvest timing is convenient, falling during a lull after Gala and Honeycrisp and before Fuji. Twenty years ago, when Red and Golden Delicious accounted for more than 80 percent of the crop, growers avoided planting varieties that matured in the same time frame as those two varieties. Now that production of those standard varieties has declined, growers are feeling the labor crunch earlier, when they’re harvesting pears and Galas, said Tom Gausman, with the consulting services company AgriMACS in Pateros, Washington.

And, importantly, workers like to pick them.

“If you have a big block of Red Delicious sitting on a busy road and it’s a good crop, you’ll get lots and lots of visitors,” Robinson said. “Emotionally, for a grower, it’s a bit like a holiday: you’re not trying to color pick it and it doesn’t bruise badly, so the stress level of picking Red Delicious is a fraction of most other varieties. There’s some attraction there.”

The fact that there are none of the problems with russet and fruit finish that growers face with other varieties is another reason growers might consider planting Red Delicious.

“I would guess there’s more incentive for an owner-operator who doesn’t have a big crew and doesn’t want to have all the hugging and kissing that goes into Honeycrisp,” Robinson commented.

“If you look at the returns back to the growers from the warehouse for established Red Delicious orchards, guys are doing very well. It’s attractive to say, ‘If I’m getting a couple of hundred dollars a bin back on Reds, sign me up!’ That would be my logic as a grower.”

Gausman said Red Delicious is particularly attractive for vertically integrated companies to produce because it is easy and efficient to pack as well as grow. “For a warehouse operation that owns the warehouse and the orchard, there’s good opportunity to make revenue on both sides pretty effectively because there’s good margins on the packing side as well.”

High yields

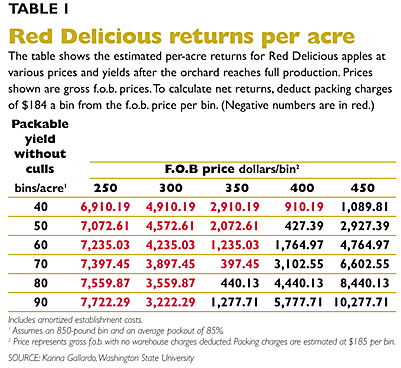

Dr. Karina Gallardo, agricultural economist with Washington State University, has just completed a study on the costs of planting and producing Red Delicious apples based on input from a team of producers, including Robinson and Gausman.

The hypothetical 25-acre Red Delicious orchard she based her study on had trees spaced 4 by 12 feet apart. She calculates that a grower needs to produce a gross yield of 58 bins per acre (assuming a packout rate of 85 percent) to break even when net return is $216 a bin.

The Washington Growers Clearing House Association reports that the average return for Red Delicious last season was $19.66 a box, equivalent to a net return of $190 a bin after packing charges are deducted, using a 75 percent packout rate. Gallardo said the study underlines the importance of both high production and prices.

“The people who are making money are the ones that are using modern practices even with a standard variety like Red Delicious,” she said.

Gausman said with the high-coloring strains of Red Delicious it’s not uncommon to produce 50 to 60 bins per acre very consistently, with packouts of 21 to 22 boxes per bin, which is one of the reasons people grow it.

Brent Milne, horticulturist with McDougall and Sons, said high yields are needed to be profitable with any cultivar nowadays.

“Just from an efficiency standpoint, I think you really have go into it with the frame of mind that you have to do everything you can to make sure productivity on a per-acre basis is as high as possible.”

Milne said there’s not just one easy way to improve yields.

“You just absolutely have to be trying every horticultural trick in your book to get as much productivity as possible on a per-acre basis,” he stressed. “I think it’s a combination of planting system and then really paying attention to your return bloom situation on an annual basis. A lot hinges on your chemical thinning programs. I think it’s the whole package.”

Jason Matson with Matson Fruit Company in Selah, Washington, who also provided input for the study, said Red Delicious pencils out for low-cost producers but not for those who have high operational costs.

For example, some other growers who were involved in the study said the cost of planting trees in a Red Delicious block could be as low as $100 per acre, which shocked Matson, who calculates that his costs for tree planting, using a GPS, are closer to $500 per acre. He also figures he uses far more ladders than others who provided input.

Good enough

“Looking at the study, I think the costs of capitalization are pretty good, but our operational costs are far higher than those outlined in the budget,” he said. “I think with Red Delicious you’ve just got to be cheap. You have to be willing to say, ‘That’s good enough.’”

Matson said he can’t do that because his family’s approach to growing fruit is far more detail-oriented, which increases costs. The company still has a lot of Red Delicious orchard and is making money while prices are high. If there’s another downturn, their detail-oriented approach won’t work, he said.

“When you look at the pruning of your Reds and you’re very detailed, it costs more, and if there’s no margin in it, you lose your shorts. We’re structured as a detail-oriented farm. When you have two extra tractor drivers, that’s another $60,000, plus $100,000 in equipment. You need more margin to cover that.”

For that reason, Matson Fruit Company is planting high-margin varieties, such as Honeycrisp.

Scott Jacky at Valley Fruit Company in Yakima, Washington, said it’s hard to come up with hard numbers on production costs because much depends on the size and type of operation. For example, if a grower with a 300-acre orchard planted 30 acres of Red Delicious, they wouldn’t necessarily buy a brand-new tractor to farm those additional acres. Maintenance costs for tractors and sprayers might also be lower for Red Delicious than for multicolored apple varieties.

Varies by farm

He also pointed out that growers might estimate different costs for certain tasks, depending on how they have their budget set up. What is included in a line item might vary from farm to farm.

Jacky said whether it makes sense for a grower to plant or continue to produce Red Delicious depends to a large degree on their sales desk and whether it has a good export market for the variety.

“We’ve had good luck at Sage

Milne said McDougall and Sons still thinks there’s a market for Red Delicious. It is not a major focus of the company, but it is part of its diverse portfolio.

“We still need to have some,” he said. “The retailers are still asking for them and if your marketing outfit is not supplying them, they’ll go to the next one who is. If we don’t carry some of everything, someone else will beat us to the punch line and pick up the business.”

Leave A Comment