A steady trend in juice grape acreage and reduced overall inventory of grape juice should lead to similar—or slightly higher—cash prices for the coming year, predicts agricultural economist Trent Ball. But he warns of big crops for Washington and New York in the coming year.

A steady trend in juice grape acreage and reduced overall inventory of grape juice should lead to similar—or slightly higher—cash prices for the coming year, predicts agricultural economist Trent Ball. But he warns of big crops for Washington and New York in the coming year.

Ball, coordinator of Yakima Valley Community College’s Vineyard and Winery Technology program, provided a snapshot of Washington State’s grape crop status by highlighting acreage, inventory, and historical statistics for juice and wine grapes during the Washington State Grape Society’s annual meeting in November. For the last 39 years, the Grape Society has featured an update on grape crop statistics during its meeting.

Current inventory levels of grape juice are down due to the small 2009 U.S. Concord crop that, at 397,000 tons, was the lowest since 2006. Inventories were average before the small 2009 crop.

The national 2010 crop is estimated at 375,000 tons, Ball reported. The average cash price for Concord grapes in Washington is $210 per ton.

Washington, the nation’s leading Concord juice producer, contributed 165,500 tons to the national crop in 2010, which is 20 percent less than the state’s 2009 crop of 205,000 tons. Washington’s crop started off late and never caught up. However, berries were small with good color and quality, Ball said.

Other major juice grape producing areas include Michigan, New York, and Pennsylvania. The 2010 crop for Michigan was “close to a disaster” due to a series of spring freezes, Ball said. About a third of the acreage was not picked, and it was the poorest production in the last ten years. New York and Pennsylvania had better crops—and should hit five-year average production levels—despite an early May freeze.

It is estimated that Washington has 21,500 acres of Concords and 1,440 acres of Niagara grapes. Growers removed an estimated 3,000 acres from 2007 to 2009, but acreage has been steady the last two years. Ball doesn’t anticipate further vineyard removal.

With juice grape acreage likely to be steady and inventories remaining down overall, the cash price for 2011 is likely to be similar or slightly higher than the current price, he concluded.

“But New York and Washington are primed for big crops next year,” he said, explaining that the long fall helped build strong wood and carbohydrate reserves. Moreover, Concord production tends to alternate, with low yields usually followed the next year with high yields.

Wine sales improving

Washington’s wine grape crop for 2010 is estimated to be 148,000 tons, down 5 percent from the 2009 crop. The cool growing season turned into a long and drawn out harvest, and a wet September resulted in high disease and rot pressures for many of the white grape varieties. Ball said that an estimated 15 percent of some white varieties were left hanging on the vine. In some cases, red varieties ripened ahead of white varieties. Merlot grape quality looked very good, he added.

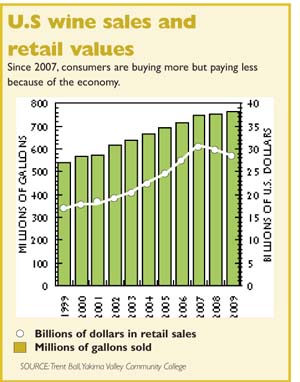

While dramatic shifts in consumer buying of wine have occurred as a result of the poor economy, wine sales in 2010 are showing improvement, he said. Consumer price points have shifted down in the last few years, but the $15 to $25 per bottle segment is growing again. Off-premise domestic wine sales in September were up 6 percent in terms of total sales compared to a year ago.

The down economy hasn’t slowed total wine consumption in the United States. Consumers are drinking more—but for less money. The volume of wine sold has steadily increased in the last ten years, from 543 million gallons in 1999 to 767 million gallons in 2009. However, the total retail value of all wines sold in 2009 was $28.7 billion for 767 million gallons, compared to $30.4 billion in sales in 2007 for 746 million gallons of wine.

Leave A Comment