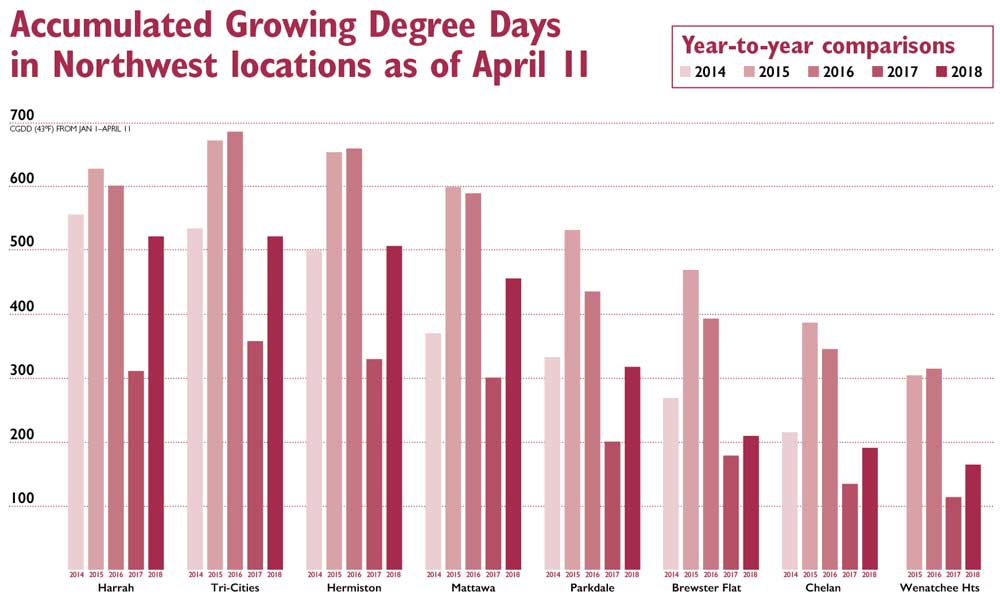

Accumulated Growing Degree Days in Northwest locations as of April 11. (Source: Northwest Cherries. Graphic by Jared Johnson/Good Fruit Grower)

As we roll into the second week of April at press time, the Yakima Valley is in full bloom on the Bing variety. Last year at this time, we were just starting to see the first early district cherries beginning to bloom. As a result, the industry didn’t ship its first cherries until June 10.

The late start didn’t help the large crop of 2017 as much of our volume missed the July 4 holiday and fell along with prices into a record 15 million 20-pound-box July.

This year we have had a much quicker accumulation of degree days on our orchards and are seeing some interesting “potential” harvest scenarios on the horizon. For starters, the growing degree-day accumulation is looking very similar to 2014, when we shipped our first cherries on May 31.

The other trend I am seeing relative to the GDD accumulation chart is that the Yakima Valley and Tri-Cities districts are very similar in degree days.

We have a long way to go before harvest, but this is the first time I’ve seen the Yakima Valley exhibiting the same GDD’s as the Tri-Cities during the month of April. Certainly, this gives me hope that we will get an early June start and have plenty of cherries to ship out prior to July 4.

The other nuance I am seeing is that our late districts are very late. At this point, that is a positive trend for the industry as we always hope to get a full 90 days to ship a Northwest cherry crop.

We have a new year with new opportunities and millions of cherry-loving consumers who are patiently waiting for our summertime delicacies to hit the market.

China tariff situation — should we be concerned?

The world media has been very focused on the developing trade war between the United States and China. As an industry, we cannot help but be concerned; fresh apples, pears and sweet cherries have been hit with a 15 percent tariff.

In the Northwest cherry business, China has become our single largest export market, surpassing Canada in 2017 by absorbing almost 3.3 million 20-pound equivalent boxes.

I’ve advised growers all winter that setting the bar high on fruit quality is the quickest path to Asia, which has continued to be a profitable market for the industry.

China represents a market we need and finding a home for millions of boxes beyond China will challenge the entire industry.

Here at the Northwest Cherry Growers, we have worked hard over the past decade to develop a niche of consumers across China.

Prior to the tariffs handed down by the Chinese government in April, Northwest cherries already charged a 10 percent import duty and a 13 percent value-added tax.

The 15 percent tariff raises our total entry taxes to 38 percent. In recent years, cherries have sold in China for between $7 and $10 a pound, so a 15 percent tariff would add between $1 and $1.50.

Despite the new tariff, our promotion dollars going into China may be more important than they have ever been. Our plan for this year is target traditional key markets of Guangzhou, Shanghai and Beijing.

Likewise, in 2018 we will expand promotions to third-tier cities; we believe there is great opportunity to grow the region of Central China known as “the middle kingdom” where there are several cities with populations of 10 million people.

The Chinese market for cherries is made up of primarily consumers who are middle income and above and are willing to pay a bit more for the Northwest’s higher quality product.

The tariff situation has led to media calls from groups like CNN, USA Today and the China Daily Times, to name a few.

Certainly, we hope that the trade issues are resolved before we begin our cherry harvest. The key is what does this mean for our growers in 2018?

Here is what we are hearing from Chinese importers and retailers — and as you might guess, it’s neither all good nor all bad:

Thoughts from Chinese Importers

Domestic Chinese cherry production is increasing, and quality is improving. Likewise, the Turkish cherry industry is making a big push into the Chinese market.

We could see a volume reduction of our cherry exports there if the cost is too high as a result of the unstable political conditions.

The current situation could evolve into an even more complicated issue for U.S. cherries given the unpredictability of the Chinese customs.

A trade war might go on for awhile, but the Chinese government could retaliate with inspection and clearance delays of the fruits. In short, this could have a bigger impact than the tariff.

The cost of U.S. fruit is high already. Any tariff will have a big impact on the selling prices during the month of July at the wholesale markets.

If the wholesale price is high and the end users (retailers) don’t absorb the cost increase, there could be large amounts of cherries stored in the coolers, resulting in a stagnant market — which could pose challenges all along the trade cold chain.

The best result will be if the quality of the cherries is good and they are reasonably priced; then movement should be stable.

Thoughts from Chinese Retailers

Higher price point(s) could impact consumer’s purchasing power and result in a lower sales volume.

Overall perception of the trade war could impact consumers’ desire to purchase U.S. goods. If the government pushes such an agenda, we could be forced to completely stop promoting U.S. goods and replace them with imported products from other countries.

A long, drawn out trade war is not set in stone. Most retail outlets are taking a wait and see approach. China and the U.S. need each other, so let’s hope the issues are quickly resolved.

Strong retail sales depend on the wholesale market prices and quality of the cherries.

The good news is that we have various market options. Certainly, our bread and butter for stone fruit sales is the North American market, and programs and media focus will be strong here on our home turf.

From an export perspective, the Northwest Cherry Growers will run promotion programs in 18 countries/markets this summer including the U.S., Canada, Mexico, the United Kingdom, Belgium, Australia, Brazil, China/Hong Kong, Taiwan, Japan, South Korea, Malaysia, Thailand, Philippines, Myanmar, Cambodia, Vietnam and Singapore.

Again this year, we have applied for and received USDA Farm Bill funding for our five-state production region of just over $1.7 million. Matched with grower dollars, we will spend 60 percent of our promotion budget in the export markets in 2018.

All Northwest cherry seasons are different and all play out in their own unique way.

Certainly, we need to export at least 30 percent of our fruit, and the domestic market will need to absorb its normal 70 percent of our volume. For today, the industry is doing everything it can to “set the table” for a successful season from start to finish! •

—by B.J. Thurlby

Leave A Comment