Once again, a familiar question popped up in the opening session of the Washington State Tree Fruit Association Annual Meeting: How many apple varieties is too many?

And while no one answered with an exact number, a few food retail experts believe the industry has passed the mark.

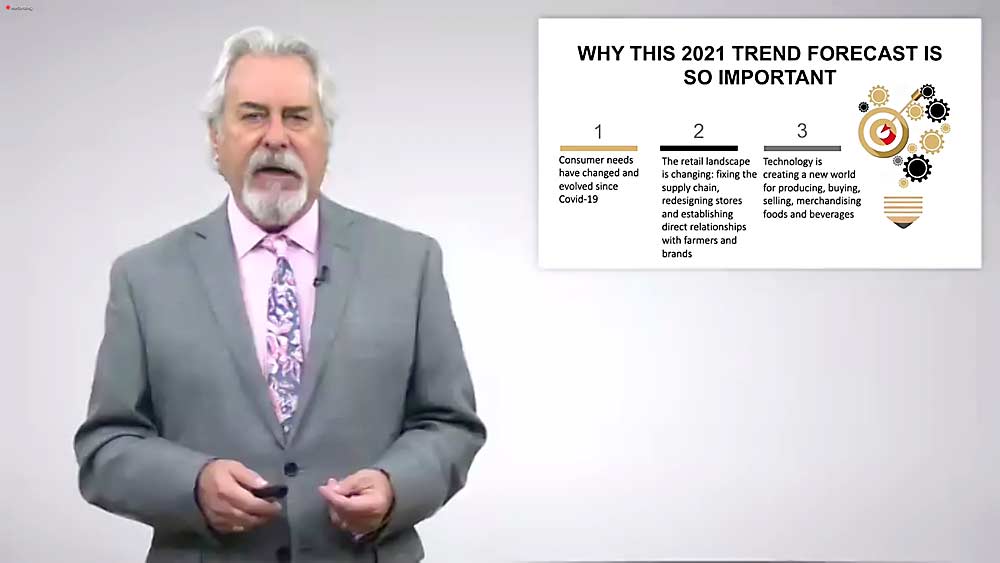

“For a lot of consumers, it is just confusion,” said Phil Lempert, a California grocery industry analyst and the keynote speaker at the three-day conference of Washington’s tree fruit industry. Other topics included policy changes, export trends, freight costs and, of course, the coronavirus pandemic. The 116th industry event, held virtually this year, continues this afternoon, Dec. 8 and Dec. 9.

Randy Riley, co-owner of GoldenSun Insights, a produce marketing trends company, had the same take later in the morning during a panel discussion, reiterating a point he made at the 2019 USApple Outlook in Chicago. Apple consumption has declined 11 percent in the past five years, he said. The industry has not “removed inferior apples” to make way for better ones, such as Honeycrisp and the newest Washington State University apple, Cosmic Crisp.

Washington State University economy professor Jill McCluskey has a research project trying to determine how much the Cosmic Crisp will cut into sales of other apples, among other variety-dynamic questions. She shared some details of those studies in the virtual meeting.

The speakers recommended the industry push for consumer education, such as in-store posters with bullet points explaining the differences in taste, texture and suggested uses for different varieties. They also advised innovation beyond orchard efficiencies and new varieties, as well as partnerships with e-commerce delivery platforms. Online grocery shopping jumped 52 percent over 2019, said Paul Jessup, a WSU economist and transportation expert.

Exports took a dip in 2020, but they had been decreasing anyway, partly due to retaliatory tariffs, said Toni Lynn Adams of the Washington Apple Commission. The biggest problem goes beyond one year, though, she said. Once market share in an export country decreases, it’s hard for Washington and other U.S. producers to get it back. In China, U.S. market share for apples went from 47 percent in the 2016–2017 season down to 12 percent two seasons later.

Meanwhile, myriad policy changes happened in 2020 and more are due in the next few years, said Jon DeVaney, president of the Washington State Tree Fruit Association, and Jim Bair, president and CEO of the U.S. Apple Association.

The Food and Drug Administration is still finalizing agricultural water quality standards under the Food Safety Modernization Act, with a graduated implementation deadline for farms of various sizes, Bair said. Also, he predicts an even larger amount of financial aid in the second round of the federal government’s coronavirus payments to make up for market losses during the pandemic. The first round yielded nearly $72 million. Also, H-2A and federal wage mandates are poised to change as the federal government continues to adjust rules, while a lawsuit by labor rights advocates in California throws a wrench into those works.

In Washington, the Department of Labor and Industries plans to adjust regulations about personal protective equipment to protect workers from smoke, the tree fruit industry is trying to get the state to extend an exemption to business and occupation taxes for companies that move money around within entities, and the proposal to charge state fees to administer the federal H-2A program may come back up before the state legislature, said DeVaney. That measure was defeated in 2019.

And most notably in the Evergreen State, courts are still trying to decide if a State Supreme Court decision exempting agricultural employers from paying overtime to seasonal workers is unconstitutional for all segments of farming, or just the dairy industry from which the case originated, DeVaney said.

These changes all came on top of the industry “adjusting to the strangeness that is 2020,” DeVaney said.

—by Ross Courtney

Leave A Comment